Financial planning for women, because life is full of surprises

Life can bring unexpected twists and turns, both good and bad. It’s much easier to deal with emergencies when we’ve prepared ahead of time. Even if you’re just starting off, it’s important to start thinking about your financial future. Making our lives easier and achieving our goals will improve our path through life at every step. Now that we’ve figured out how to meet our immediate financial obligations, we can start thinking about long-term financial goals like investing and borrowing.

Financial planning is more important for women than men because of the numerous stages of life and experiences that women go through. There is no doubt that how prepared we are for life’s unexpected turns plays an important part in the quality of our lives. We are aware that what is beneficial to males is not necessarily beneficial to women.

The lives of women are full of obstacles and responsibilities, both at home and in the office, because of the many roles, they must play. Taking care of their children’s emotional and physical needs, as well as their own financial and medical requirements, is a never-ending struggle for them. Their personal financial needs may be overlooked during this time, which could have a negative impact on them in the long run.

Women have a particular responsibility to consider carefully how they may take charge of their financial situation. Not only do women earn less than males, but in order to make up the difference in pay, they must work longer hours and, in some cases, are given bad advice.

Women in Different Roles and Circumstances Need a Unique Financial Plan

Regardless of her job title or social standing, every woman’s financial situation is unique. Depending on the situation, there are various scenarios or conditions in which a woman may require specific financial planning. Consider, for example, Sheela, a doctor who wants to save money and buy gold as a long-term investment. Regardless of how much money she makes, she prioritises emergency savings and planning. As a single woman, she prioritises having a backup plan because she doesn’t have a lot of financial responsibilities. Additionally, she invests in Fixed Deposits and a modest amount of Equities.

Isn’t it possible for her to take chances in this situation? With a little financial understanding and guided financial planning, it is possible to handle risks effectively.

A single mother who has to plan for her children’s futures is Dr. Ratna 33, who lives in Bangalore and takes care of her two young children while also keeping savings money in case of an emergency. As a result, one of her top tasks might be to build a plan for fulfilling her retirement goals.

“Financial Independence comes with a Solid Financial Plan.”

Why Women need to take an Active Role in Planning their Finances?

We have listed some of the key factors that help understand why Women need to play an active role in Managing their Money.

- Women live longer than Men: It is evident from the recent report published by WHO in 2020, that life expectancy in India is: male 69.5 years, for females 72.2 years and total life expectancy is 70.8 years. Women will have to keep their money supply for a longer time, making more provisions for a larger retirement kitty along with other expenses for additional burdens along the way. Relying on property ownership and assets is not a good option even if the law makes provisions for equal rights, but men tend to own assets and there are a social impediments and complications to implementation. More the responsibilities, more the expenses to take care of. Considering the additional burdens in case of a divorce, it does hit your financial plans adversely. More so there could be children to be taken care of and the alimony often falls insufficient considering the rate of inflation, making early financial planning all the more important.

- Men earn more than Women: It is a well-learned fact that women earn lesser than men. Looks like another generation of women will have to wait for gender parity, the “World Economic Forum’s Global Gender Gap Report 2021” published in 2021 showed that India has slipped 28 places to rank 140th among 156 countries in widening the gap further. The lifetime earnings of women are lower than men even in same rank careers, this gap widens if there is a career break for family situations such as childbirth, affecting their current pay scale, savings and SIPs for regular investment. The come back to a different job profile will also affect their pay scale. Without a proper financial plan, it will just make things tougher.

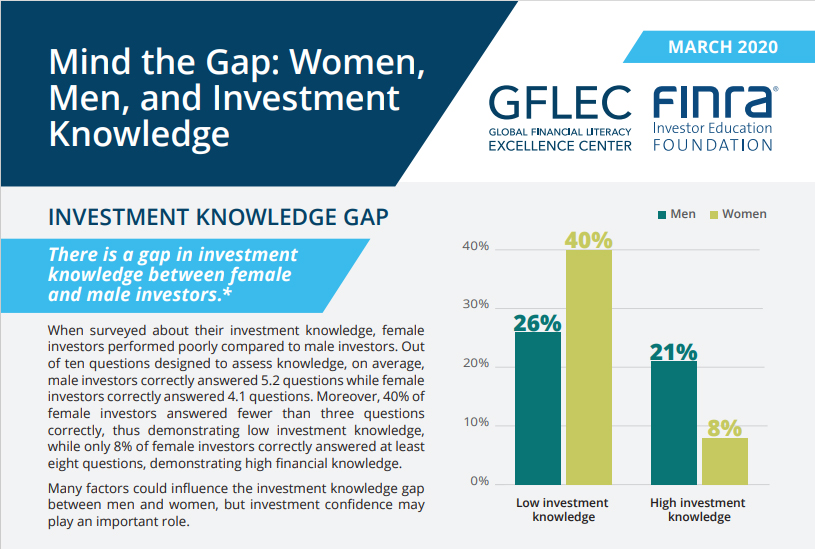

- Mind the Gap: Making matters worse with high needs and lesser savings is a result of lack of financial savviness. Most women are less financially literate, and this is further proved in the report by Global Financial literacy Excellence Centre survey in March 2020. When surveyed about their investment knowledge, they performed poorly compared to male investors. You see can the Graph below which shows the performance of women out of ten questions designed to assess their knowledge.

- Large Difference in Investment Confidence: There are significant differences between male and female investment confidence, this is the case even in developed countries. The level of education, income and investment knowledge are significant factors that control investment decisions. For Eg: A high-level knowledge investor has more likely to a retirement plan. A recent report by Women & Money Power 2022 survey released by LXMe says only 7% of women in India invested independently through self-learning.

Need for a Financial Advisor for Women

Now that we know that women typically require assistance with financial planning, how much money should we set aside each month for various expenses, whether we’re single mothers or a woman who is the family breadwinner? When women begin saving for retirement later in life, the amount they should put aside each month varies on their age.

Women may be familiar with many financial products, but they may not know how to invest properly because one approach to saving and another to investing is very different. Many people lack confidence because they don’t trust the facts that financial institutions have released. This is where a financial advisor comes into play, as they can handle the financial intricacies and assist you to determine whether you are on track or off track with your financial goals.

Either way, it’s never too late to be guided by the right person on the right path, isn’t it? Even in the case of Financial Planning. Contact us for a free financial consultation.

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).