Best Financial Consultancy in India for NRIs

NRI Money Plus will help you with intelligent investments and prudent financial planning. We offer optimal results in both the short and long term, even during economic downturns.

Our Execution Partners

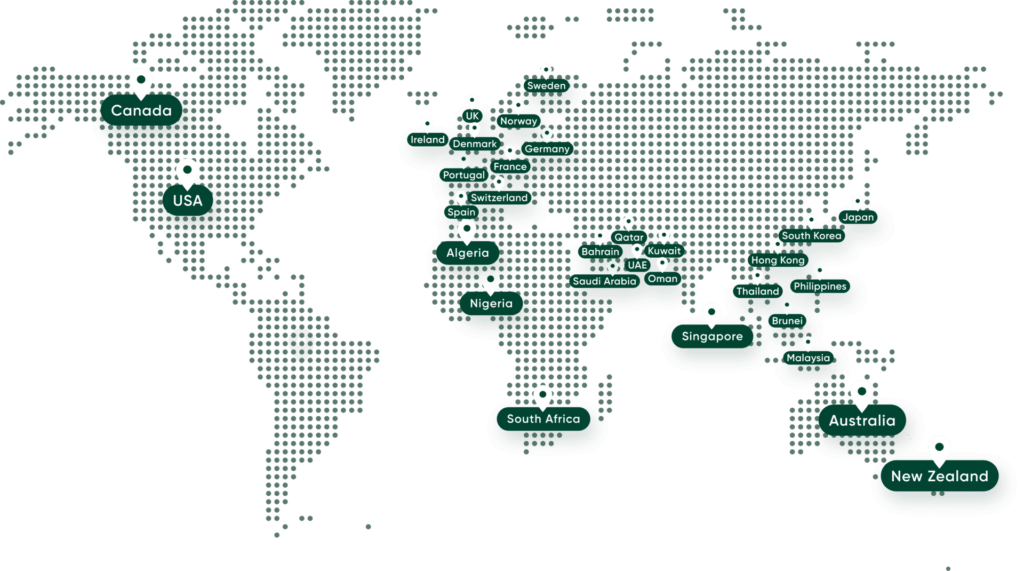

Serving NRIs from 30+ Countries

Looking at the bigger picture

- Higher GDP Growth prediction than other developed countries

- Positive outlook ahead as more foreign companies to invest in India

- India's Sensex has delivered higher returns than it's other foreign counterparts

As one of the fastest growing economies, India offers a wide range of investment opportunities to NRIs, across a variety of asset classes. With investment opportunities ranging from equity, fixed income, real estate and more, India has continued standing as an attractive investment destination.

How NRI Money Plus Make a Difference

We provide financial solutions complete personalised for you, using diverse investment instruments. Not only will these investments grow your wealth, but it will also add value to your life.

Structured Products

A structured product is an instrument that can be tailored in multiple ways. These are manufactured by few entities to provide a risk-to-return that is not available in a conventional way. The taxation arbitrage that currently exists for listed, market-linked structures products provide an edge over the vanilla bond that pays out interest. For this favourable taxation, this has recently been a must-have product with HNI’s who are happy to look at equity returns with a debt product risk. The minimum investments on these products start at Rs 10 lakh.

Alternative Investment Funds

Our partner's dedicated investment teams manage/advise funds across four distinct businesses – Performing Credit, Real Estate Credit, Special Situations and Infrastructure Yield. Edelweiss India Alternative Equity Fund follows a multi-strategy approach including fundamental long Indian equities, fundamental short Indian equities and event arbitrage strategies.

Government Securities

As mentioned by Forbes.com, Indian government bonds are a highly secure, low-risk investment. G-Secs are backed by the full faith and credit of the Indian government, meaning that you are all but guaranteed payments and the return of your principal investment upon maturity. Being a fast developing nation, the investment is utilised for the infrastructure development in India.

Dynamic Asset Allocation Fund

These are hybrid funds that invest in both debt and equity investments. They are very flexible in terms of their investments. This means that depending on market conditions they can quickly increase or decrease their portfolio holdings and shift between equity and debt investments. Being dynamic, the allocation is controlled by a series of algorithms without the need of manual command from the investor.

Legacy Wealth with a Term Insurance

Term insurance is a strategic investment to create and transferring wealth as your legacy to your loved ones. Essentially, it's the same as "estate planning," but you can create your wealth by investing just a fraction. Moreover, buying insurance from India is much cheaper than getting it from a developed country.

Start Your Journey of NRI Financial Planning Today!

NRI Wealth Creation

If you don't take care of your savings, they will lose purchasing power over time as costs rise. We assist you in accumulating wealth by increasing your savings by outpacing inflation and reducing your incidental taxes.

Post-Retirement Income

It's possible that your retirement years will last as long as your working years. If you don't plan ahead of time, your golden years may not be as bright. There is no fear more terrifying than outliving your money. We can assist you in creating a meticulous retirement plan that will allow your golden years to truly shine.

Education Planning

Make sure that your children receive the education that they deserve. Allow them to make their own decisions without having to worry about the costs. In your quest to see your child graduate from a prestigious university, we partner with you to create an education fund that will assist you in covering the cost of education.

NRI Second Income

We have many options available for you to create a regular income, whether it's for your days in between jobs, your retirement years, or creating that second income. Tax exemptions are included in the regular income plans we create for you, and your cash flows may increase as inflation rises. With our regular income planning, you'll never have to worry about inflation.

NRI Term Insurance

Buying a term insurance from India is much cheaper for a NRI, than buying it from any developed country. Make sure that your loved ones at home do not face financial hardships in case of your unexpected demise. We assist you in putting in place a solid insurance plan to cover both your family's needs and the value of your human life.

Global Health Insurance for NRI

Get yourself completely covered with a health insurance that will support you and your family in any country around the world. Get a health insurance cover of up to ₹ 6 Crores that works internationally.

Features

- Throughly Researched Investment Concepts

- Seamless Online Investment Experience

- Diverse Investment Instruments

- IRDAI Certified Advisors

- Completely Personalised for You

Benefits

- Better Returns on Investment

- Choice of Different Levels of Risk

- Achieve Peace of Mind

- With Reliable Insurance Cover

- Achieve More in Life

Latest Articles on NRI Matters

NRI term insurance in India is emerging as the go-to protection tool for global Indians, with Gulf and US-based NRIs driving record growth. Competitive pricing, rupee-based payouts, and easier documentation are making Indian policies more attractive than international alternatives, sparking a major shift in buying behaviour.

Read MoreNRI Return to India stories reveal that moving back home can be more challenging than expected. From power cuts and traffic to emotional adjustment and culture shock, returning NRIs share common struggles. This article explores real experiences and offers practical steps to prepare for a smoother transition.

Read MoreThis article explains how Indian tax law applies in such situations, with a focus on the Double Taxation Avoidance Agreement (DTAA) between India and Australia. Conflicting advice from local accountants and online sources is common in these cases. The safest approach is to assume that as a tax resident of India, you must declare your global income and assets, and...

Read MoreA Reddit post on r/rupeesstories by a 47 old NRI investor (Software Programmer by profession) residing in USA since 2006, has triggered widespread discussion in personal finance circles, highlighting the underperformance of Indian real estate when measured against global benchmarks like the S&P 500. The now-viral post, titled "15 Years, ₹64L in a Hyderabad Flat, $8.5K Profit: Missed $210K vs....

Read MoreHere are some key questions you should ask yourselves before making a decision for early retirement abroad. Early retirement abroad isn’t just about escaping the corporate grind — it’s about upgrading your lifestyle, enhancing your wellbeing, and redefining what retirement means to you.

Read MoreHere are some practical tips to help Indian retirees make the most of their move to Thailand. Retiring in Thailand offers a chance to redesign your life — balancing relaxation, adventure, and meaningful work while enjoying affordable living and cultural richness. Careful planning will ensure that your golden years are truly golden.

Read More