Have you been affected by Non-Repatriable Amounts? These words have tormented many NRIs due to misguidance or sheer ignorance. If your money lands as non-repatriable you can’t take this money to your resident country to enjoy it.

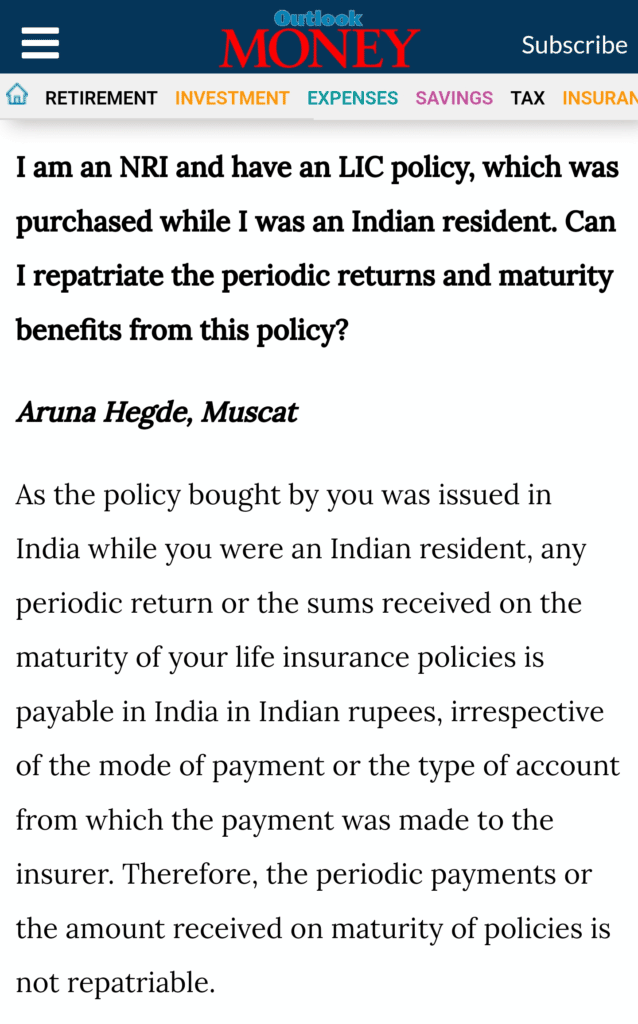

Yesterday I received a WhatsApp message from Mr. Bala who has settled in the US.

“I have a NRO account at IOB Bangalore. One of my HDFC insurance got matured and a sum 25 Lac is directly deposited by HDFC in this account. I want to transfer this balance to USA. I was told that we can get a CA certificate and transfer this amount but the IOB manager told my friend that the amounts in NRO is non-repatriable. How to deal with this?”

I asked him “Did you pay the premium in US Dollars or Indian Rupees?” He replied –

“I have paid all 10 annual premium from the same NRO account only. The same check was done by HDFC insurance in India.

5 years back I used 15CB to transfer the money received from house sale. It was done at Deutsch Bank but this IOB bank telling the money in NRO account is non-repatriable. May be this is a small bank does not deal with foreign exchange or individual manager knowledge.”

Obviously, the agent from HDFC insurance who sold the insurance policy to Mr Bala didn’t do a good job of guiding him.

Repatriable describes something as capable of repatriation. Repatriation brings back home something brought to or acquired in a foreign country. Something is repatriable if the laws of both the foreign and home country permit and don’t impede their repatriation.

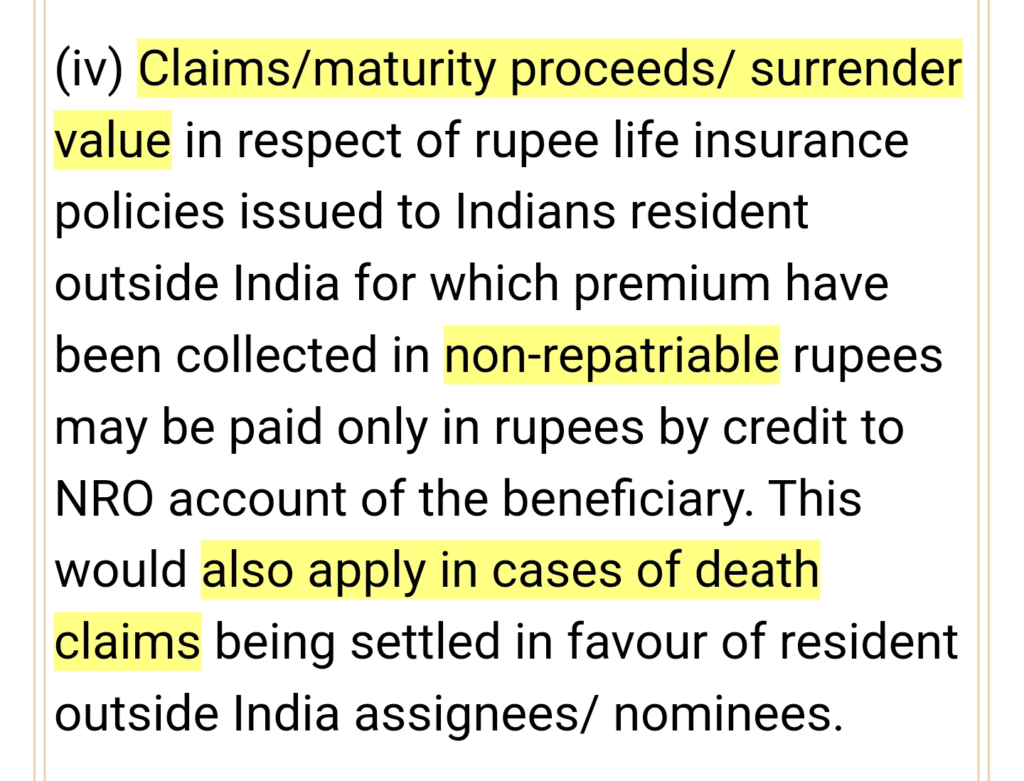

According to the Reserve Bank of India’s Foreign Exchange Management (Insurance) Regulations, 2015 –

Claims/maturity proceeds/ surrender value in respect of rupee life insurance policies issued to Indians resident outside India for which premium have been collected in non-repatriable rupees may be paid only in rupees by credit to NRO account of the beneficiary. This would also apply in cases of death claims being settled in favour of resident outside India assignees/ nominees.

Conclusion

The claims/maturity proceeds/surrender value of a Life Insurance policy issued to an NRI where the premium was paid in Indian Rupees shall be settled only in Indian Rupees.

Payments in foreign currency/ NRE account will be permitted only in proportion to the amount of premium paid in foreign currency/ through NRE account.

NRIs or foreign nationals can repatriate claims, maturity proceeds or surrender value of policy outside India, however, this would depend on the source of fund/account from which the premium has been remitted/paid and the manner in which the claims etc. are to be repatriated. Free repatriation is directly linked to the type of fund/source used at the time of investment and depends on existing RBI guidelines at the time of repatriation.

If you have any questions related to repatriation and need a solution for a non-repatriable amount, kindly send them to me at hello@nrimoneyplus.com with the subject ‘Non-Repatriation Help’.

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).