If you are an NRI, then buying the best term insurance plan in India is a lot cheaper than buying it from the country you are working/residing in. So why not buy the Best Term Insurance Plan and still save money?

Why Should You Buy Term Insurance?

Term insurance is a necessity for Indians both inside and outside of the country of origin. It is a pure insurance plan that makes sure that in the event you die too soon, your nominee (family or the person you choose will get a death benefit) will be ensured the continuation of income by payment of a lump-sum amount (cover amount). The nominee can choose to invest this amount and receive a steady income for months to come. Just for this, you should get a term insurance plan. Read further to know why to buy a term insurance plan in India.

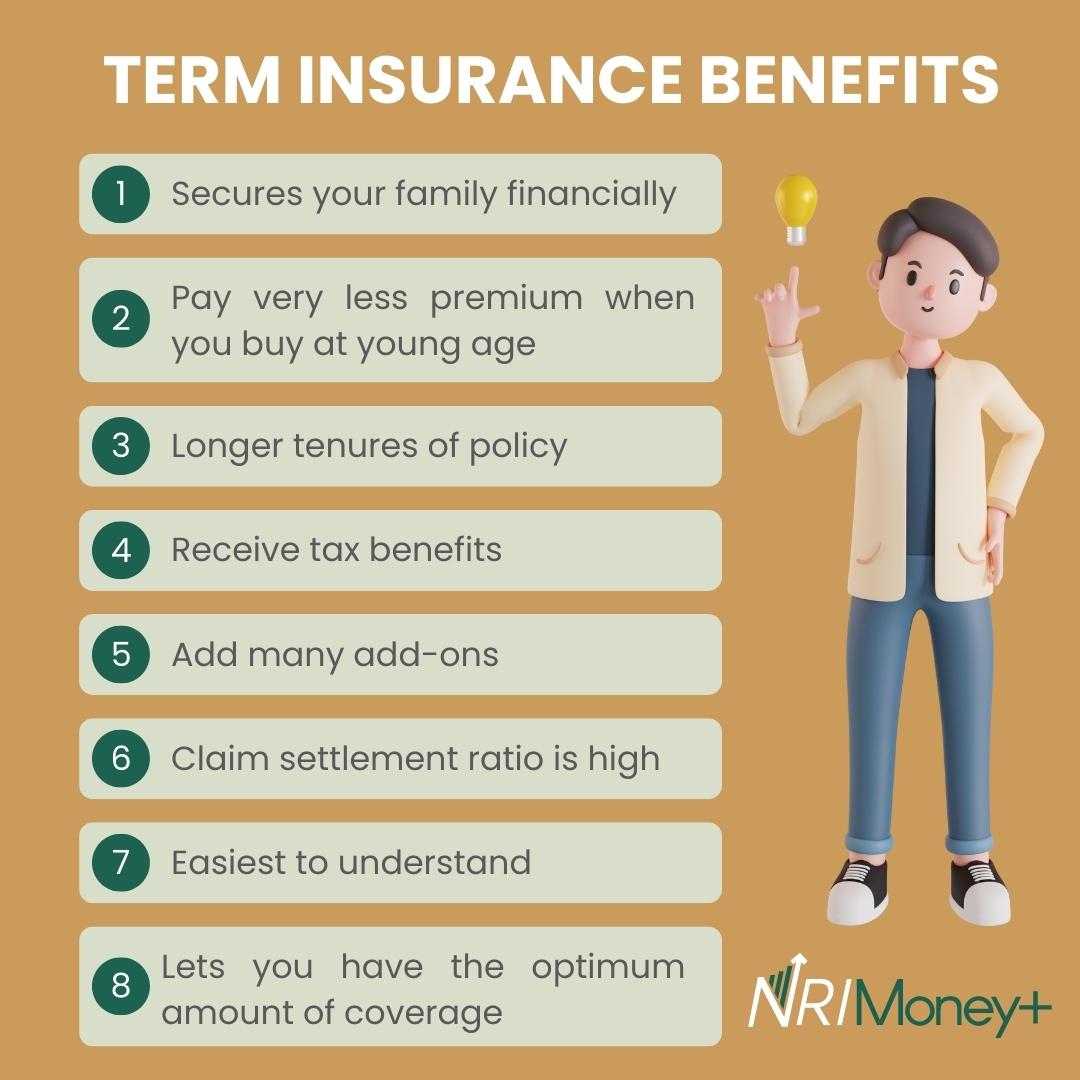

Term Insurance Benefits

-

It secures your family: Term insurance comes to the rescue when you are no longer around.

-

You get lower premiums if you are young when you buy the policy.

-

You can have longer tenures of policy.

-

You can receive tax benefits.

-

You can add as many riders (add-ons) as you need.

-

Term insurance plans are secure: The claim settlement ratio is high, and the death benefit is guaranteed if you follow the process correctly.

-

It is the easiest to understand among all insurance policies.

-

It lets you have the optimum amount of coverage required depending on the premium: See to it that you are getting it from a reputed insurance company.

Buying a Term Insurance Plan in India

Because of the Foreign Exchange Management Act, NRIs and PIOs are now able to buy a term insurance plan in India. Moreover, some insurance companies like Max Life Insurance offer term plan that will cover NRIs globally. Because Indian Insurance companies accept payment on foreign currencies, NRIs can take advantage of the recent depreciation of the Indian currency. This will enable them to spend lesser US dollars to pay their premium, yet get the same cover. NRIs can also opt to complete the payment in 5, 10, 12 or 15 years and get a life insurance cover upto 85 years of their age.

Keep in mind the following points to ensure that you are getting the best term insurance plan in India:

1. Consider the stage of your life

This should be the first thing you do when trying to figure out what term insurance plan in India is available to you. The policy you choose depends on how much money you have and how many people depend on you. It changes how much you can have as your “sum assured” and how long the policy will last.

Also, everyone has different financial responsibilities. If you are the only person in your family who brings in money, your family may depend on you for a long time. The same might not be true for someone who is not married. When looking for a term insurance plan in India, you should think about how well you can pay for it.

2. Check the claim settlement ratio

On its official portal, each company will explain how often claims are paid out. Please look at it before you sign up with that insurance company. The more stable your plan is, the higher the number. You need to make sure that if something bad happens, your family will get your hard-earned money as soon as possible. Currently, Max Life Insurance leads with a 99.34% claim-settlement ratio. This has kept Max Life Insurance as the best choice when you buy a term insurance plan in India.

3. Know your choices when you buy a term insurance plan in India

There are two main types of term insurance plan in India: those that automatically renew at set times and those that reduce coverage after a certain age. There are plans for 5 years, 15 years, 25 years, and 40 years that can be renewed. There may be rules based on how old you are. For some, the age of 65 may be when they can get the most coverage.

The policy that has to be renewed every year is never the best choice. Companies don’t accept claims that are renewed more often. The 25-year term policy is by far the most popular one right now. This lets them raise the policy’s rate before the plan runs out.

Some insurance companies will even let you turn the plan you bought into a permanent life cover. Most of the time, they don’t charge any extra fees to do this. Learn as much as you can about your choices and choose the one that works best for you.

4. Choose how you want the policy to pay out

When you buy a term insurance plan in India, you can choose from different payout options for your policy, such as:

– A lump sum to the person you choose in case of your untimely death. This will help you a lot if you have a loan or other debts to pay.

– A payment that is made regularly for a set number of years.

– A monthly income that goes up every month. This, too, is available for a certain amount of time.

– Part of the amount you’re insured for. An income every month will follow. This is for people who have to pay for big things like a child’s college education.

5. Opt for add-ons

You can add riders to a term insurance plan in India that you think will help you the most. A few of them are the return of premium benefit, critical illness cover, accidental death cover, and waiver of premium benefit. Choose the one that will help you the most and add it to your policy to get the most out of it.

6. Ensure that you are getting a sufficient sum assured

In this area, the average policyholder often makes a mistake. So that they can lower their premium, they choose a lower sum assured. Look for a term insurance plan in India that give you at least ten times your current annual income. You can even try to go further if you want to. But if your rate is lower than this, it will be very low by the end of your policy’s term.

You can use a human life value calculator if you’re unsure what to do. If you’re worried about your premium going up every year, you should use a term insurance premium calculator.

7. Opt for the premium waiver benefit

Some companies will not charge you any premiums if you become disabled or lose your ability to work. While buying a term insurance plan in India, check to see if this is covered by your insurance. You can’t ask someone else to pay your insurance premiums for you.

8. Practice maximum caution when making a choice

When buying a term insurance plan in India, carefully read the insurer’s disclaimer. You are making a choice of your own free will. If you lose money, you might only have yourself to blame.

There is no question about whether or not you should get insurance. But you are the only one who can look into term insurance plans and decide which one would be best for you. Contact us at NRI Money Plus today for a free consultation.

Which is the Best Term Insurance Plan in India 2021?

NRI Money Plus recommends a Max Life Term Insurance called Max Life Smart Secure Plus Plan. Max Life Smart Secure Plus Plan is a customizable plan that offers comprehensive protection against critical illness, disability, and death. This term insurance plan in India provides 360- degree financial protection to your family in your absence.

Download Documents

Policy Leaflet | Policy Prospectus | Policy Contract | Rider Leaflet

What is the Minimum Sum Assured for Max Life Smart Secure Plus Plan?

Under the Max Life Smart Secure Plus Plan, the minimum sum assured for the base death benefit option stands at INR 20 lakh, while for secondary life (in joint life), it stands at INR 10 lakh. For the Accelerated Critical Illness benefit option, the minimum sum assured will be INR 5 lakh. On choosing the Accident Cover option, individuals can get a minimum and maximum sum assured of INR 50,000 and INR 1 crore, respectively.

Let’s Discuss the Benefits of the Max Life Smart Secure Plus Plan in Detail!

As we mentioned earlier, Max Life SSPP is the best term insurance plan in India according to our research. We are discussing the different benefits of the Max Life Smart Secure Plus Plan – Two Death benefit options, terminal illness cover, maturity benefit, etc. – in detail. Have a look!

1. Two Death Benefit Options

With the Max Life Smart Secure Plus Plan, policyholders can choose between two death benefit options according to their preferences – Life Cover and Increasing Life Cover.

With the life cover option, the base sum assured will remain the same throughout the policy term. On the other hand, with increasing life cover, the base sum assured will increase at a rate of 5% per annum every policy year (up to 200% of the base sum assured).

Nominees can also choose to receive the death benefit from different payout options – as a lump sum amount, as monthly income (in 120 instalments) or part lump sum & part monthly income.

2. Terminal Illness Cover

If a policyholder is diagnosed with a terminal illness, he/she will get 100% of the guaranteed death benefit (up to INR 1 crore) as part of the policy benefits. The medical practitioner needs to provide certification regarding the terminal illness.

3. Maturity Benefit

On choosing the Return of Premium option with your Max Life Smart Secure Plus Plan, you will get all your premiums paid back (during the premium payment term) as maturity benefit if you survive till the policy term.

4. Accident Cover

If a policyholder dies due to an accident, his/her family will get the sum assured (for accident cover) along with the base cover. Policyholders can choose this additional cover anytime during the premium payment term by paying an additional premium amount.

5. Accelerated Critical Illness Cover

If a policyholder gets diagnosed with any of 40 specified critical illnesses, you will get the base sum assured along with the Accelerated Critical Illness cover if the policy is in force.

6. Special Exit Value

With this option from Max Life Smart Secure Plus Plan, policyholders can get a one-time option to exit the policy. Upon exit, individuals will receive an Exit Benefit on return of premiums for the base cover only. Also, your policy will terminate once your premiums have been returned.

7. Joint Life Benefit

If you are looking for a policy that can take care of your spouse’s needs after you, this may be a preferred choice. A significant concern when buying term insurance is the financial care of your spouse in case of an unfortunate event. Therefore, choosing a policy like Max Life Smart Secure Plus Plan can give you peace of mind. When buying the Max life smart secure plus plan, you can choose a joint life cover to secure your partner’s life along with yourself. Here’s how it would work:

- In case your spouse meets with an untimely demise before you or is diagnosed with a terminal illness, a guaranteed death benefit of Rs. 10 lakhs will be payable to the beneficiary, and the primary life cover will continue at a reduced premium and the original sum assured chosen by you will be payable to your spouse in the pay-out option of their choice.

- In case you suffer an unfortunate incident before your spouse, and if in the future, they are diagnosed with a terminal illness or pass away, the guaranteed death benefit of Rs. 50 lakhs will be payable to the nominee. Additionally, it comes with a built-in premium waiver, meaning premiums will be waived off for your spouse’s sum assured, upon your demise. Riders for Additional Benefits.

What is the Policy Term for Max Life Smart Secure Plus Plan?

Under the Max Life Smart Secure Plus Plan, the policy term depends on the benefit type. To know more, you can check the below table.

| Benefit Type | Minimum Policy Term | Maximum Policy Term |

|---|---|---|

| Base Cover | 10 years | 67 years |

| Accelerated Critical Illness (ACI) | 10 years | 50 years |

| Accident Cover | 5 years | 67 years |

What is the Premium Payment Term?

Individuals can choose a premium payment term for Max Life Smart Secure Plus Plan at the time of the inception of the policy, and it will depend on the policy term chosen. To know more, check the below table.

| Premium Payment Term | Base Policy Term | Accelerated Critical Illness Policy Term | Accident Cover Policy Term |

|---|---|---|---|

| Single Pay | 10 to 67 years | Not Available | Not Available |

| Regular Pay | 10 to 67 years | 10 to 50 years | 5 to 67 years |

| 5 Pay | 10 to 67 years | Not Available | 10 to 67 years |

| 10 Pay | 15 to 67 years | 10 years | 10 to 67 years |

| 12 Pay | 17 to 67 years | 10 to 12 years | 10 to 67 years |

| 15 Pay | 20 to 67 years | 10 to 15 years | 10 to 67 years |

| Pay till 60 (the premium payment term will be equal to 60 less entry age) | Policy term should be greater than premium payment term, up to 67 years | 10 to (60 less entry age) years | 6 to 67 years |

Max Life Smart Secure Plus Plan Eligibility Criteria

Check the eligibility criteria for the Max Life Smart Secure Plus Plan mentioned below.

- The minimum entry age stands at 18 years, while the maximum age can be 65 years.

- The maximum maturity age can be 85 years for Base Death Benefit and Accident Cover, while it stands at 75 years for Accelerated Critical Illness benefit.

About Max Life Insurance

Max Life was ranked 18th amongst ‘India’s Best Companies to Work For’ in 2021 by Great Place To Work Institute 2021.

Claims Paid Percentage (Highest in India)

99.34% (Source: Max Life annual audited financials FY 21-22)

Max Life Presence

269 Offices (Source: As reported to IRDAI, FY 21-22)

Sum Assured

₹1,174,515 Cr. In force (individual) (Source: Max Life Public Disclosure, FY 21-22)

Assets Under Management

₹1,07,510 Cr. (Source: Max Life Public Disclosure, FY 21-22)

In A Nutshell

Each year the cost of living is steadily rising, and along with that, the threats to life have multiplied. Having a life insurance plan for your family’s future is integral in such a scenario to be prepared against any uncertainties. The Max Life Smart Secure Plus Plan can be a valuable addition to your financial plan because of the varied multiple benefits and features.

Here are some reasons why you should choose the new Max Life SSPP:

1. Comprehensive Financial Security

The availability of death benefit options and several add-on benefits make the new Max Life SSPP a suitable instrument to get comprehensive financial security. If you understand your personal financial requirements well and project your future needs cautiously, you can choose the right combination of features and benefits with the Max Life Smart Secure Plus Plan.

This will enable you to build an all-inclusive financial security plan that can efficiently protect you and your loved ones. If your family members are dependent on your income, it is of utmost importance that you begin investing timely.

2. Health Component

Max Life (Max life smart secure plus plan) comes with a terminal illness benefit that entitles you, the insured person, to the sum assured of up to Rs. 1 crore, in case of diagnosis of a disease. In the absence of a plan like Max Life Smart Secure Plus Plan that offers 100% of the sum assured in case of a terminal illness(capped to 1 cr), you may face an immense financial burden to cover the respective medical expenses.

Additionally, The health component of the Max Life SSPP is a desirable advantage, considering the rise in cases of critical illnesses in recent years. Therefore, Max Life offers a critical illness and disability rider which can further strengthen the cover and provide valuable financial assistance to you. Health-related expenses are the most significant sources of financial drain in a person’s life. It may be unpleasant to think of yourself or your family suffering, but it is crucial to be financially prepared for such situations.

Max Life Smart Secure Plus Plan Features

- Max Life Smart Secure Plus plan is a comprehensive term insurance plan providing financial assistance for various kinds of emergencies.

- This insurance plan offers a host of benefits fulfilling the varied financial requirements of individuals.

- It comes with the Return of Premium option wherein upon surviving the policy term, you receive all the premiums paid. This benefit is available with both base covers, and all policy terms, and premium payment terms.

- Max Life Smart Secure Plus plan comes with a unique feature of Premium Break. This feature allows you to take a premium break from paying the premiums once the policy completes 10 years of tenure. During a premium break, the policy remains active with the risk cover option as per the policy terms and conditions. You can opt for this option twice during the premium payment term. This feature is available for policies with policy term over 30 years and premium payment term over 21 years.

- Under the Special Exit Value of Max Life Smart Secure Plus plan, you get a one-time option to exit the policy with an exit benefit of Return of Premiums only in case of the base cover. Once the premiums are returned, the policy gets terminated. This option is available if the policy tenure for the pure protection plan is over 40 years. It is not available with the return of premium variant.

- With the Voluntary Sum Assured Top-Up feature, the sum assured can be increased at a later stage of the policy tenure. If the chosen sum assured is greater than or equal to Rs 50 lakhs, you can exercise this option after completing one policy year. The cover can be increased up to 100% of the base sum assured. This option is available for a policy with a minimum term of 10 years and a minimum premium payment term of 5 years. It can be exercised after 1 year waiting period from the time of policy issuance.

Max Life SSPP Policy Leaftlet

> For guidance on Max Life SSPP please click here.

> Term Insurance Calculator

> HDFC Term Insurance vs Max Life Smart Secure Plus Plan

You May Like to See These Videos:

Max Life Smart Secure Plus Plan Exclusions

Max Life Smart Secure Plus Plan does not cover death due to suicide within 12 months from the policy commencement or the date of policy revival; the policy shall terminate immediately. In such cases, the insurer shall only refund the total premiums paid plus underwriting extra premium plus loading for modal premiums paid (but exclusive of taxes, cesses & levies as imposed by the Government from time to time) to the nominee.

In case the policyholder has chosen to increase the sum assured using Voluntary Sum Assured Top-Up option, the suicide clause will be applicable on the increased sum assured due to Voluntary Sum Assured Top-Up option.

Hence, if the life insured commits suicide within 12 months, from the date of increase in sum Assured due to Voluntary Sum Assured Top-Up, the nominee will get Sum Assured under the base policy + return of additional premium (Total Premiums Paid plus underwriting extra premium paid plus loading for modal premiums paid) that was paid to increase the sum Assured because of Voluntary Sum Assured Top-Up. The increased sum assured will not be paid as suicide happened within 12 months of the increase in sum assured due to Voluntary Sum Assured Top-Up.

Financial matters are complex, more so if you are an NRI. But managing them is not impossible.”

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).