Retirement planning can be difficult for anyone. These factors exacerbate when it comes to NRI retirement planning.

The reasons can be divided into two categories: those that affect everyone and those that affect NRIs specifically. Let’s look at both.

Typical NRI Retirement Planning Concerns

What is the definition of retirement?

Retirement simply means that you have dedicated close to 30 to 40 years to your work and that, as you grow older, you can no longer function as effectively as you once could. As you get older, this is a natural progression.

For some people, retirement means no longer having to work for a living but only for pleasure. Retirement may come sooner for these people than for the majority of people.

When is it suitable to retire?

Is it better to retire when you reach a certain age threshold or when you can’t find a new job? Should one retire completely or continue working in some capacity until the mind and body allow it?

How long do you think you’ll be retired?

You may not leave your house for the office on the first of the month, as you have for many decades, but you do not stop living! Retirement merely denotes a break from work (for the most part, the 9-5 grind), not from life itself. Thanks to improved healthcare, more people are living into their 90s and even 100s.

What would be your post-retirement lifestyle?

Would you prefer to stay at home or meet up with friends and family, as well as travel extensively? If given the opportunity, everyone would prefer the latter. It entails a decrease in income but an increase in expenses.

How much money is required to retire?

For different people, the answer to this question would be different. Even for the same person, the answer would vary depending on their financial and, more importantly, mental circumstances. For example, a 30-year-old woman may estimate that she will need at least Rs. 5 crores to retire at the age of 50. However, due to changed circumstances, she may change it to 10 or even 15 crores when she reaches 45.

Must Read : Why NRIs Should Save For Early Retirement?

How do NRIs retire rich In India?

Retirement Dilemma of NRIs

NRIs face additional challenges in addition to those listed above. The most common stumbling block is deciding whether to retire in the country where you worked or in India. Most developed economies have far superior lifestyles than India, but they lack the social support of family and friends.

Most Indian cities lag behind in terms of educational and career opportunities, as well as healthcare facilities. But so are spending and living costs. A middle-class NRI couple from the United States or the United Arab Emirates can retire in India as part of the top 1% simply because the cost of living is low and the exchange rate is favourable.

For example, according to the PPP, the value of 1 USD is not INR 74.31 but only INR 20.65. (latest data for 2017). It means you can buy almost four times as much in INR as you can in USD – though due to high duties, the price difference on some luxury and imported goods would be much smaller.

Why Time Is Money When it Comes to NRI Retirement Planning?

Let’s now turn our attention to the one question that was left unanswered earlier.

Your present – your state, habits, behaviour, and actions – determine your future. Your future is also determined by how you handle money and how you want to live. Expecting too much after retirement, beyond your means, can be a constant source of resentment – now and then.

However, if you only have one thing on your side – TIME – you can change this.

Earnings, spending, saving, and investing habits are all important. Without a doubt, asset classes and risk/reward categories are important. And there’s no doubt that luck plays a role in your financial future, whether it’s not losing money, surviving emergencies, or striking it rich with an investment.

However, with enough time on your side, you can minimise the vagaries and volatility in most of your investments and retire with a respectable corpus.

When you have time:

Over time, you will earn more.

If you are not struck by bad luck on a regular basis, your income will increase over time. Salary appraisals, job changes, increased business income, consulting work, investment income, family history, property sales, and a variety of other factors could all play a role. This simply provides you with a competitive advantage that no other rate of return can match.

You have more money to save and invest.

You have less money when you’re young, but you also have fewer responsibilities. Parents are still working and are in good health, while you are single or recently married with no children. You can easily move up the corporate ladder by changing jobs and cities. If you can save first and spend later, you will be able to save and invest more over time.

Compounding is a benefit of regular investments.

When you invest on a regular basis, you earn income from both your principals and the income generated by those principals. This is the fundamentals of compounding. Compounding can work wonders if you let it work for you for a long time. That is why Albert Einstein dubbed it the “eighth wonder of the world”!

Volatile assets, such as stocks, have a long runway and can outperform your wildest expectations.

Equity is the most volatile asset class; we do not consider cryptocurrency to be a reliable asset class, so we will not invest in it. Even with equity, if you stay invested in high-quality mutual funds or stocks for the long term, you’ll notice that the volatility fades and the curve begins to slope upward.

Numbers don’t lie.

Here are a few examples of why “Time in the Market” is more important than “Timing the Market” (by the market we mean any financial asset like bank deposits, G-Sec, Bonds, or Equity). To keep the examples simple, we don’t factor in the effects of taxes and inflation.

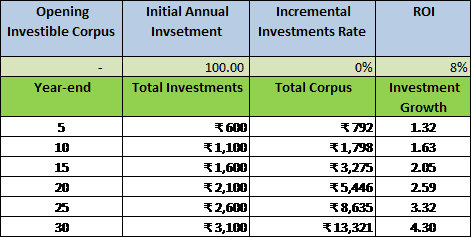

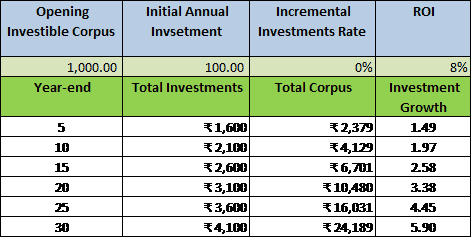

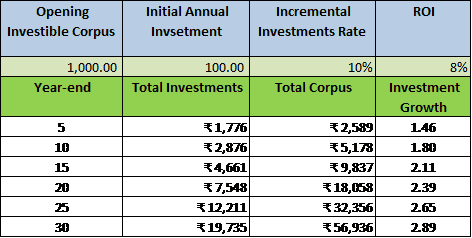

In these examples, the long-term Roi is set at 8%, which is slightly higher than the inflation rate, resulting in positive returns. If you lower your expectations to more realistic returns of 10% to 15%, the results can be spectacular. The following classes are used to categorise the examples presented here:

- Starting from scratch vs. using a corpus

- Investing the same amount on a regular basis vs. increasing your investment

Rs. 100 annual investment @ 8% – No initial Investment, No incremental investment

Rs. 100 annual investment @ 8% – Rs. 1000 initial Investment, No incremental investment

Rs. 100 annual investment @ 8% – Rs. 1000 initial Investment, Incremental investment @ 10% p.a.

As the preceding examples demonstrate, the real gains from long-term investments are realised at the end of the investment period.

“Our Favorite Holding Period Is Forever,” says Warren Buffet, the world’s most famous investor. Only if you have the tenacity to persevere through the journey’s ups and downs will you discover a pot of gold.

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).

Pingback: Top 10 NRI Investment Options in India - NRI Money+