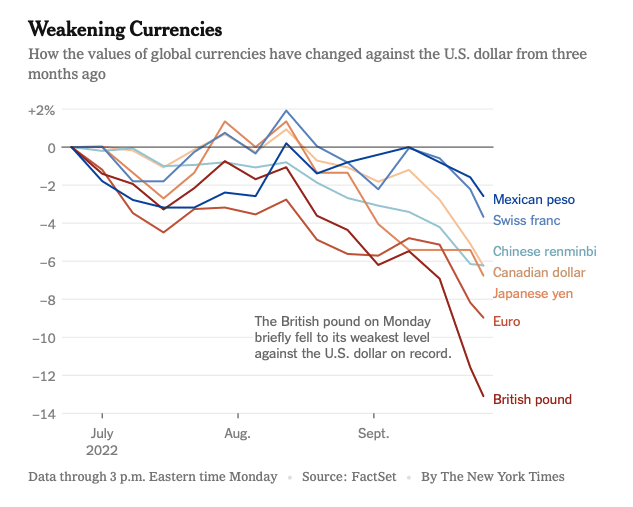

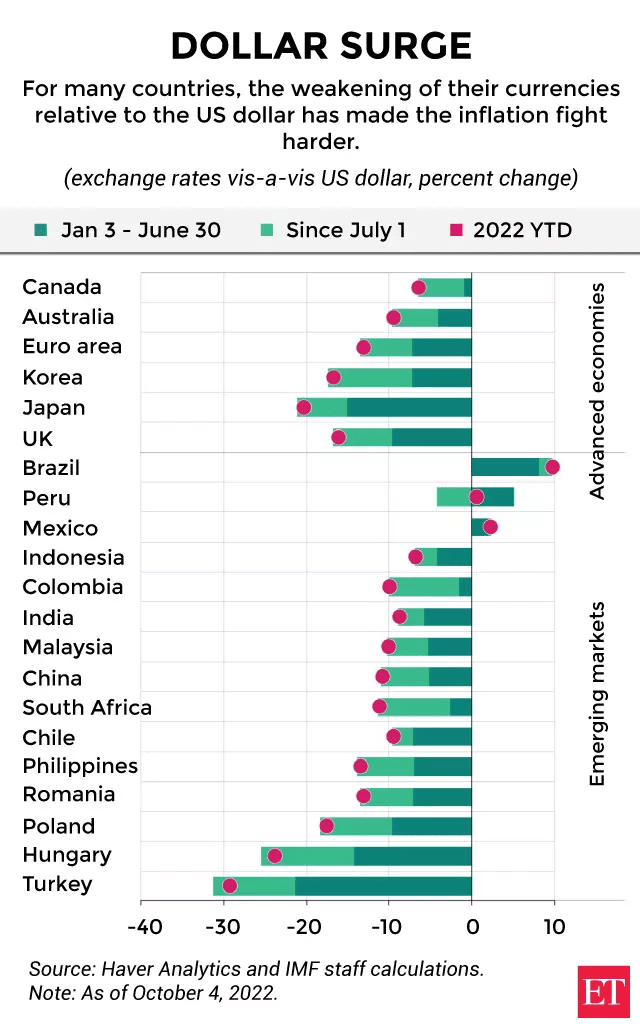

Let’s start with the bad news and come to the good news later. the Indian Rupee depreciated this week to a new all-time low and touched 83.32 level in the futures market amid a strong dollar and continued FII’s outflow from domestic markets. The U.S. Federal Reserve may have had no choice but to wage a relentless inflation fight, but countries rich and poor are feeling the pain of plunging currencies.

The US Federal Reserve is raising interest rates to fight inflation in the USA and the increase in interest rates is pumping up the value of the US Dollar. But with this, it is causing economic turmoil in both rich and poor nations — pushing up prices, blowing up the size of debt payments and increasing the risk of a deep recession. The British pound touched a record low against the US Dollar as investors baulked at a government tax cut and spending plan. And China, which tightly controls its currency, fixed the renminbi at its lowest level in two years while taking steps to manage its decline.

In African countries like Nigeria and Somalia, where the risk of starvation already lurks, the strong dollar is pushing up the price of imported food, fuel and medicine. Moreover, debt-ridden countries like Argentina, Egypt and Kenya are closer to default and threatening to discourage foreign investment in emerging markets like India and South Korea.

All this is because the US Dollar is the world’s reserve currency — the one that multinational corporations and financial institutions, no matter where they are, most often use to price goods and settle accounts.

Energy and food tend to be priced in dollars when bought and sold on the world market. So is a lot of the debt owed by developing nations. Roughly 40% of the world’s transactions are done in US Dollars, whether the United States is involved or not, according to a study done by the International Monetary Fund.

Should India Be Worried About Its Rupee Value Compared to US Dollar? No Need To.

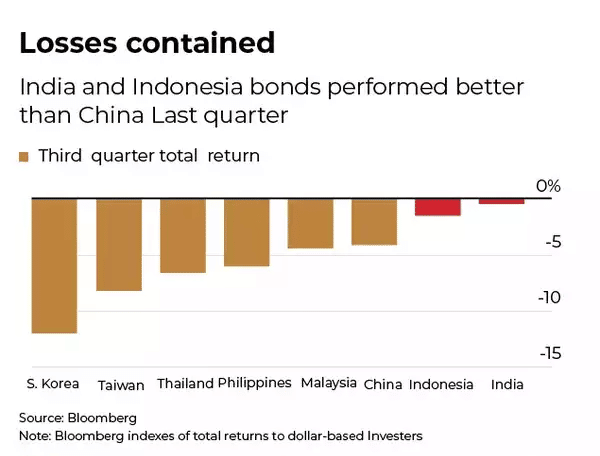

Coming to Asia, there is a different story. The Indian rupee and the Indonesian rupiah were the top-performing emerging Asian currencies in the three months to September, as per Bloomberg. Indian bonds are offering shelter from extreme volatility in global markets. India’s sovereign debt only lost 0.4% for dollar-based investors in the third quarter, less than other emerging markets in Asia including China, according to data compiled by Bloomberg. India knocked China off the top spot as the best performer in the region.

Indian bonds are offering shelter from extreme volatility in global markets. India’s sovereign debt only lost 0.4% for dollar based investors in the third quarter, less than other emerging markets in Asia including China, according to data compiled by Bloomberg. India knocked China off the top spot as the best performer in the region.

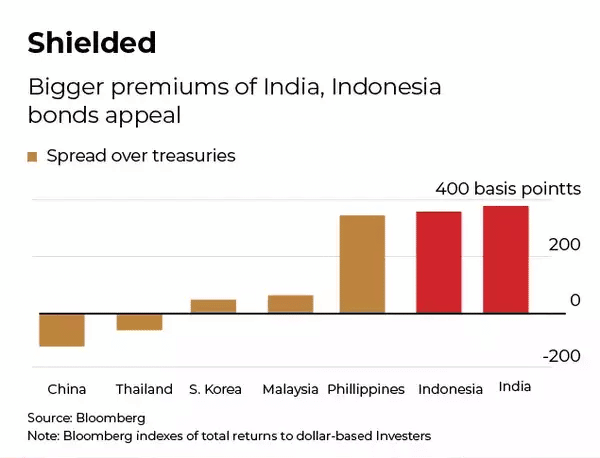

India, with Indonesian notes, have the widest spreads in emerging Asia, helping to sheild investors from the turmoil in US Treasuries, which had the longest string of quarterly losses in almost a decade.

Relative resiliency in Indian Rupee is also the key with the rupee supported by larger Reserve Bank of India intervention, according to Duncan Tan, a rates strategist at DBS Group Holdings Ltd, Singapore.

India’s notes have been supported by foreign inflows and signs that the market is nearing the peak in the rate hike cycle. Another positive is the prospect of inclusion into global indexes.

India is still the Preferred Investment Location for Foreign Institutional Investors (FIIs)

In comparison to the same quarter in the previous year, India’s economy grew by 13.5% in the April-June 2022 quarter. Along with defying expectations with these double-digit GDP growth figures, India became the preferred investment location for foreign institutional investors (FIIs), who invested 56,521 crores in Indian equities in just a month of August 2022.

Let’s take a look at some of the reasons why India is thriving even in the face of growing concerns that a global recession will endanger economies all across the world.

Stronger growth fundamentals than peers

India, which only trails China in terms of population, has the advantage of a significant demographic dividend that will likely drive demand for at least the ensuing ten years. Given that more than half of the population is of working age, India continues to be a prime location for international corporations to establish bases and take advantage of the numerous pro-business initiatives implemented by the current government.

The amount of money invested by foreign businesses and investment arms is rising, with FY2021–22 seeing the largest annual Foreign Direct Investment (FDI) inflow of $83.57 billion for India. The increase of the middle class in India, a growing desire for luxury items, and unabated consumer spending amid skyrocketing inflation are the ideal conditions for a period of high single-digit GDP growth in the near future.

Key indicators hitting all-time highs

Other macro indicators, such as record-high credit card spending, manufacturing and services purchasing managers’ index (PMI) coming in at an 8-month high, and strong auto sales, point to an economy that is booming across all demographics in addition to direct indicators like GDP, FDI inflows, and even FII investments. Even more cyclical industries, like real estate, have emerged from a multi-year trough to set records for home sales in the nation’s rural and urban hinterlands.

India is dominating the world in terms of digital adoption as well thanks to the United Payment Interface (UPI), which facilitates ever-increasing digital payments. India is also home to more than 100 million cryptocurrency investors. This indicates not only the rising propensity of young Indians to try out new products and services, but also the potential market for a wide range of MNCs that have previously shied away from the world’s fifth-largest economy.

With the IMF’s growth forecasts corroborating India’s brighter prospects in an otherwise gloomy macro environment, FIIs will probably continue to infuse more capital into India’s sunshine sectors going forward. As the country progresses towards becoming the third largest economy by 2027, only behind the USA and China, it can be surmised that other investor classes will probably join the bandwagon sooner rather than later.

What are the Investment Opportunities for NRIs in India?

From Government Bonds and Corporate Bonds to Pure Equity, there are immense opportunities for NRIs to invest in India. NRIs residing in US have an upper edge as they will be able to invest more in Indian rupees for lesser dollars, due to the recent growth of US dollars. NRI Money Plus can advise on investment in Nifty-based or Leap Index-based Structured Products for higher growth for your investments. Get in touch with us.

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).