After months of speculation, economists have finally confirmed a 2023 recession is 100% likely.

An economics report recently released by Bloomberg predicts a wide-reaching economic slump, stating that unemployment in the U.S. could reach as high as 6% next year, up significantly from 3.5% in September. What about the rest of the world? What about India?

The Covid-19 pandemic hit the global economy hard. And even as the economy struggled hard to recover from this, the Russia-Ukraine war arrived as another great setback. These two factors combined are expected to push the global economy into recession next year.

Major output loss in 2023

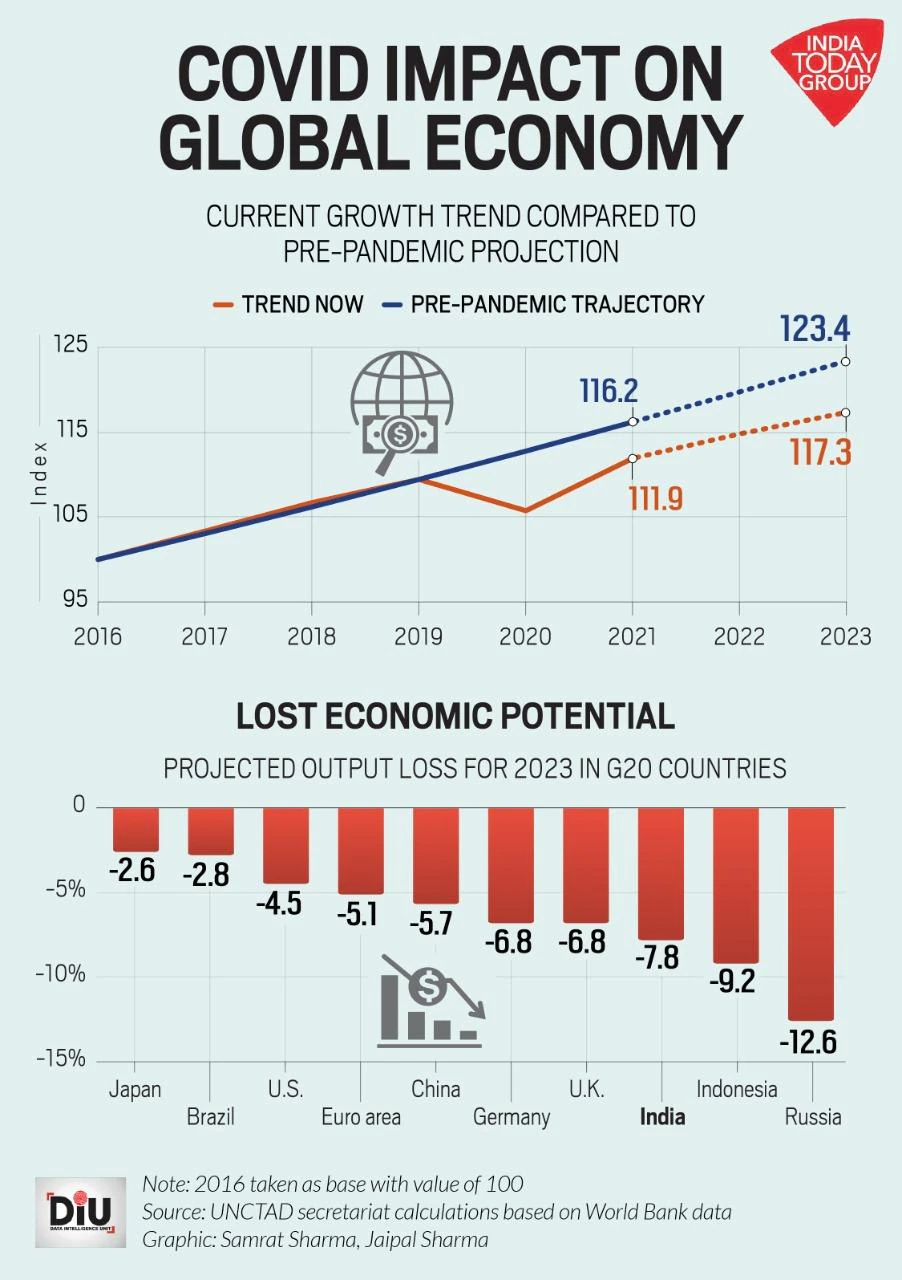

The global output would have risen 23 per cent since 2016 had the pandemic not happened. Now, however, it is projected to grow only 17 per cent. The global slowdown will leave real GDP still below its pre-pandemic trend and is expected to cost the world more than $17 trillion, which is nearly 20 per cent of the world’s income.

Russia, Indonesia, India, the UK and Germany are among the countries that may contribute the most to this global output loss, a United Nations Conference on Trade and Development (UNCTAD) report observed.

While India may bear an output loss of 7.8 per cent in 2023, the Euro area is expected to lose 5.1 per cent, China 5.7 per cent, the U.K. 6.8 per cent, and Russia may bear 12.6 per cent output loss. Rising interest rates, weakening of currencies, mounting public debt and all these factors raising food and fuel prices have introduced uncertainty in the global markets.

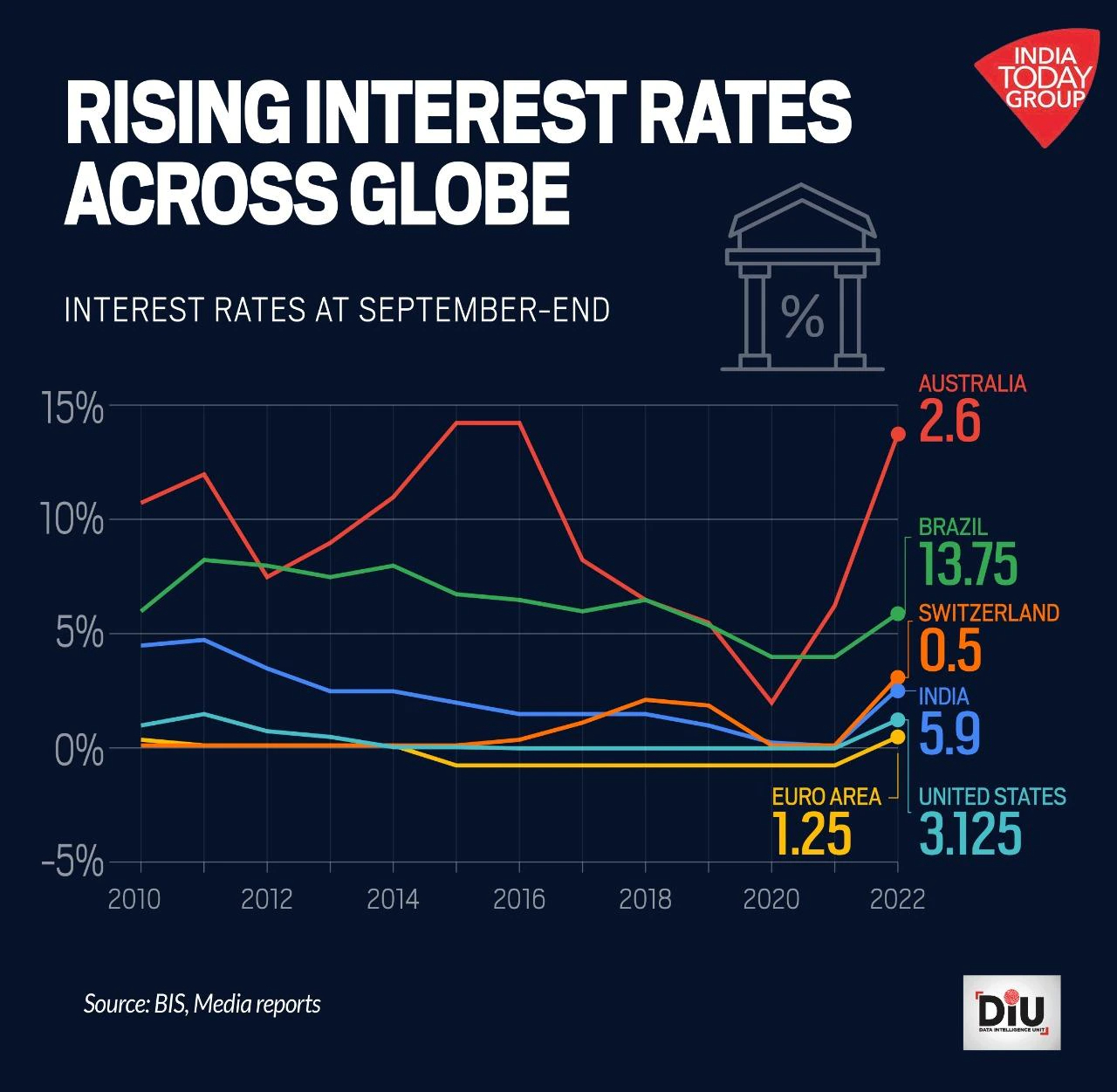

Rising interest rates to arrest inflation

A new World Bank study shows that central banks across the globe raising interest rates to curb inflation may not be a good idea. This can likely lead to various financial crises along with the recession.

“Global growth is slowing sharply, with further slowing likely as more countries fall into recession. My deep concern is that these trends will persist, with long-lasting consequences that are devastating for people in emerging markets and developing economies,” said World Bank Group President David Malpass.

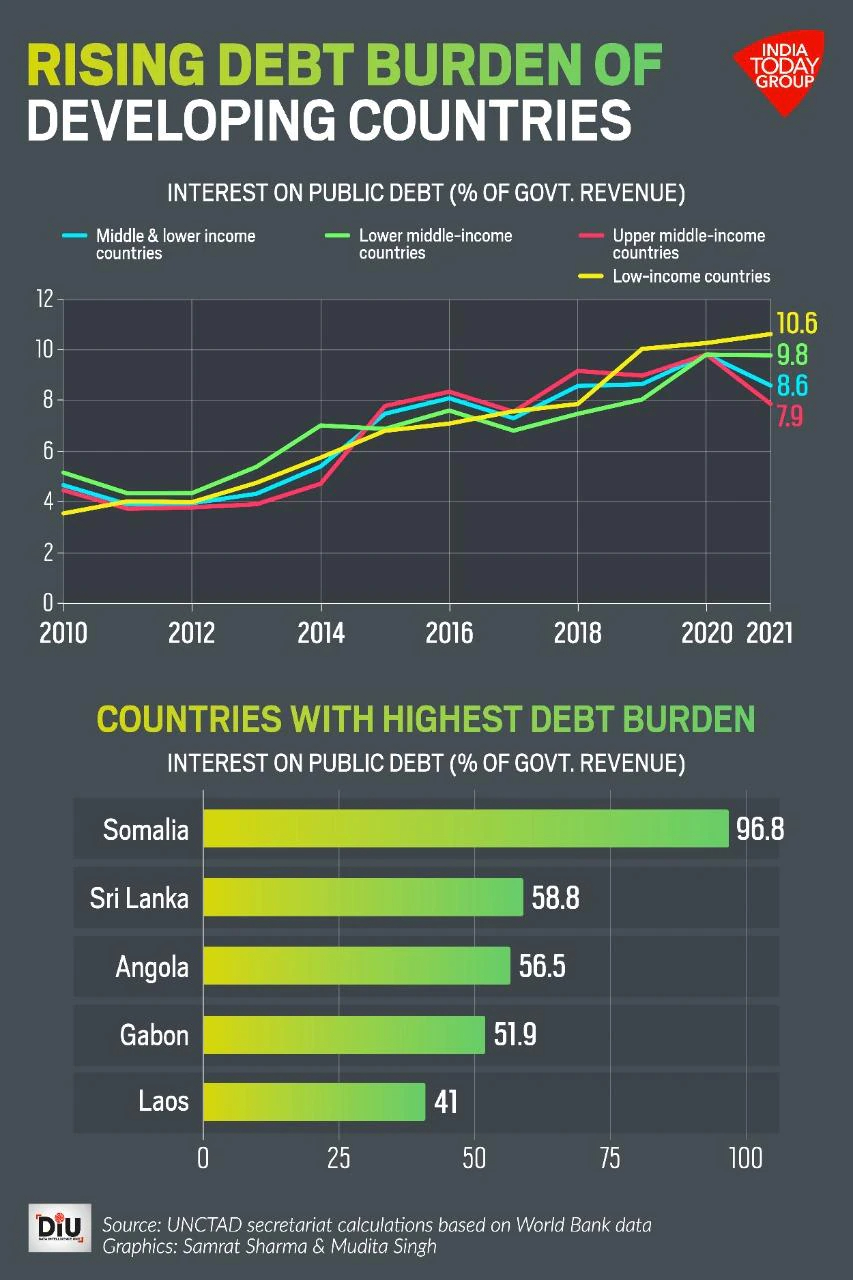

Mounting public debt

The International Monetary Fund (IMF) has pointed to the possibility of a recession next year as well. IMF’s MD Kristalina Georgieva said earlier this week that the world economic growth may be lower by $4 trillion through 2026. Things are more likely to get worse before they get better, she added.

While all regions are expected to be affected, alarm bells are ringing the loudest for developing countries, many of which are edging closer to debt default. Lower-income and lower-middle-income countries are spending more money to service their public debt. Somalia, Sri Lanka, Angola, Gabon, and Laos are the countries with the highest proportion of revenue required to service their public debt.

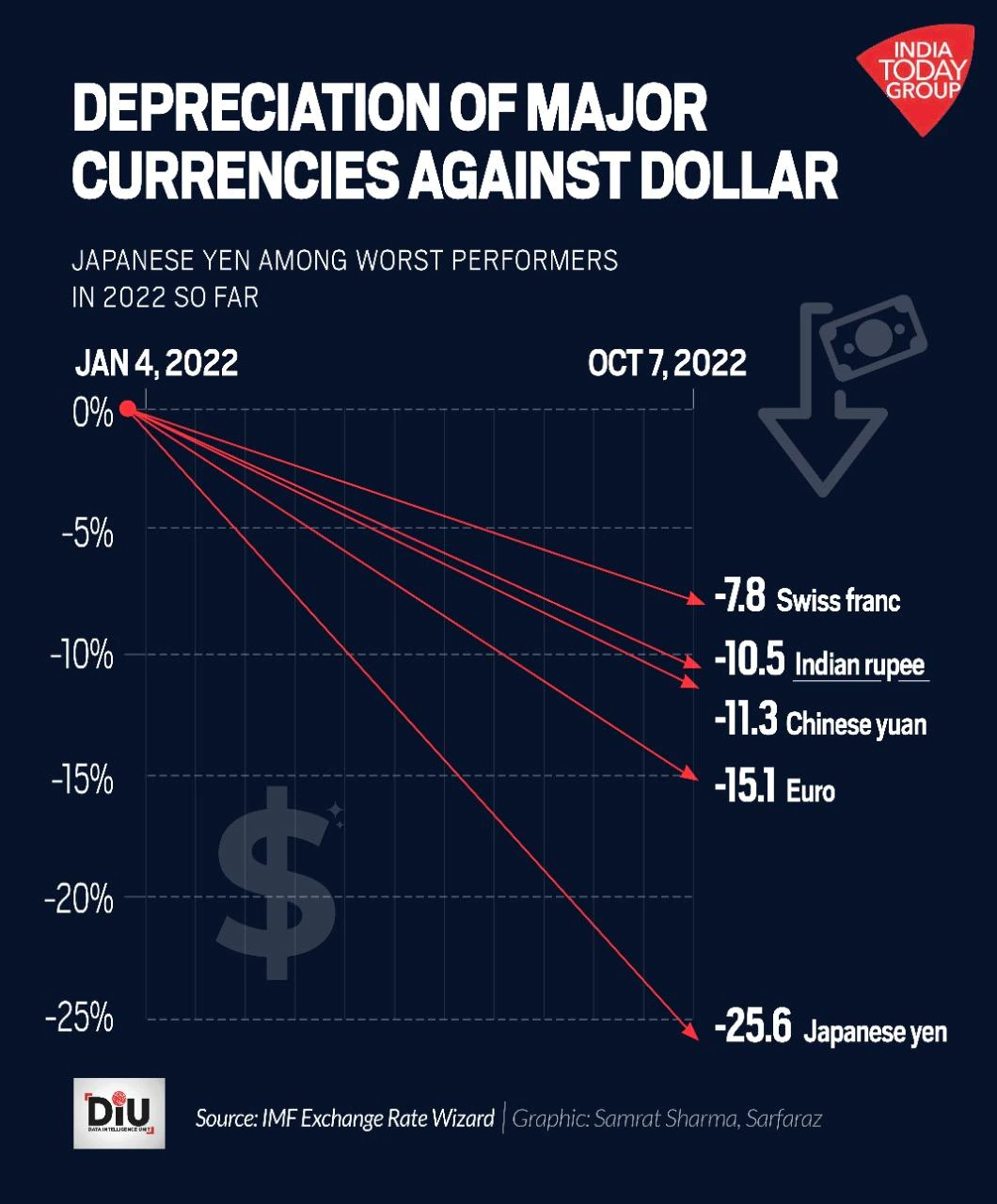

Weakening currencies

In an effort to cushion weakening currencies, developing countries have spent nearly $379 billion of their reserves, which is nearly double the amount of new Special Drawing Rights (SDR) by the IMF. The value of an SDR is based on a basket of the world’s five leading currencies: the US dollar, euro, yuan, yen and the UK pound.

It is estimated that the interest rate hikes by advanced economies are hitting the most vulnerable hardest. Almost 90 developing countries have seen their currencies weaken against the dollar this year — over a third of them by more than 10 per cent, the UNCTAD noted.

Costly food and fuel

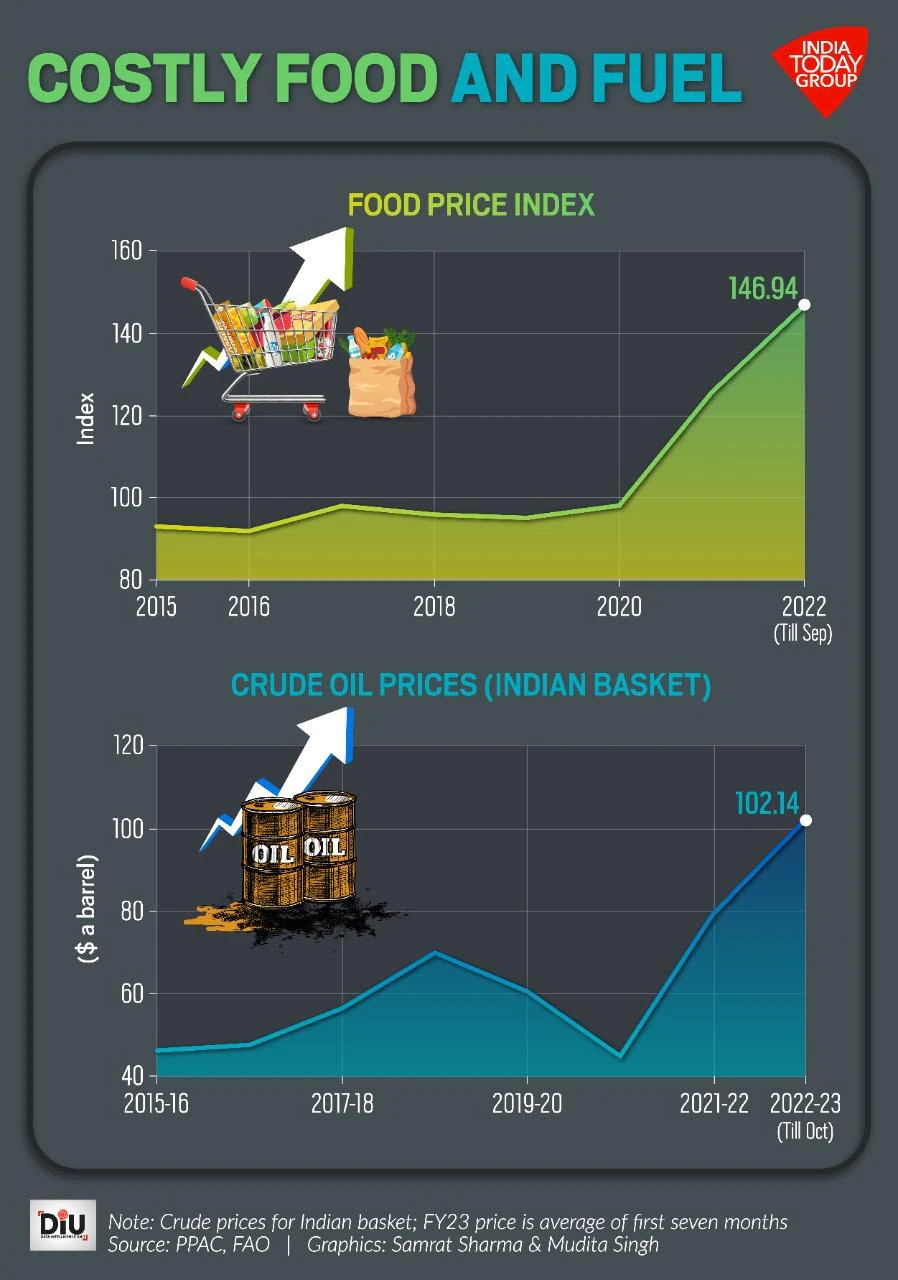

Food and energy are two factors that directly affect the lives of common people. The year 2022 has seen a dramatic rise in food and fuel prices. While the food price index rose to a lifetime high of 125.7 in 2021 and further to 146.94 by September 2022, the Indian basket of crude oil prices averaged $102.14 a barrel from April-October 2022.

The price of the Indian basket of crude oil was $79.18 a barrel in 2021-22 and $44.82 a barrel in the previous financial year.

How Index Annuities Work in a Recession

If your chosen index strategy provides growth, your annuity goes up in value. But, on the other hand, if the index strategy dives, your annuity’s value stays the same as before. It’s that simple.

What is Annuity

An annuity is a fixed amount of money that you will get each year for the rest of your life. An annuity is a contract between you and an insurance company that requires the insurer to make payments to you, either immediately or in the future. It helps you to get a regular payment for life after making one lump sum payment or a series of instalments.

Features of annuity

Below are some of the key features of an annuity plan:

1. Safe investment option

Annuity plans are low risk plans that are not market-linked. The amount you receive is guaranteed1 and is fixed at the time of the purchase of the plan

2. Financial security

Annuity plans provide you with an income for life. This helps you stay financially independent during your retirement

3. Flexibility

These plans offer you the flexibility to choose how you want to receive your income. You can choose to receive the income from the plan monthly, quarterly, half-yearly or yearly. Some annuity plans also offer you the flexibility to pay your premiums monthly, half-yearly, yearly or all at once as per your convenience

What are the different types of annuities?

There are two types of annuities:

Immediate annuity plans

There is no accumulation phase and the plan starts working right from the vesting phase. It is purchased with a lump sum and the annuity payment starts immediately either for a limited tenure or lifetime.

Deferred annuity

These are the pension plans in which the annuity starts after a certain date. It can be further divided into the following:

The annuities may also vary basis the type of payout you receive:

Fixed Annuity

Simply put, an annuity plan that gives you a guaranteed1 amount throughout the tenure of the policy is a fixed annuity plan. This guaranteed amount is pre-decided at the time of purchase of the policy. The amount paid to you is guaranteed. It does not get affected by market fluctuations.

Variable Annuity

In a variable annuity plan, your premiums are invested in instruments, such as mutual funds or equities. Payouts from such plans depend on the performance of the fund your money is invested in. If the fund performs well, you will get greater returns and vice versa.

- Accumulation phase – It is the phase when you start investing and accumulating cash and commences from the date when you first time pay premium.

- Vesting phase – It is the date from which you will start getting the policy benefits in the form of pension.

Types of Annuities

How do different types of annuities work?

Annuities provide you with a regular income during your retirement throughout your lifetime. They offer various options to choose from, to suit your retirement needs. Here is how they work:

Life annuity

You will get regular (monthly/quarterly/yearly) annuity payouts from the scheme till you are alive. The annuity stops after your death.

Life annuity with return of purchase price

You will continue receiving annuity payments regularly until you die. After that, the insurer returns the initial amount, which was used to purchase the annuity, to your nominee. It is a good option for those who want to leave a legacy behind.

Annuity payable for a guaranteed period

The annuity is to be paid for a guaranteed period, say 5, 10 or 15 years even if the annuity buyer dies. Annuity stops either on the death of the annuitant or completion of the guaranteed period, whichever is later.

Inflation-indexed annuity

Every year, there will be a rise in the annuity payable at a certain rate, say 2% or 5%. Though it may not be linked to the actual inflation rate, the rationale is that it would take care of the increase in expenses to some extent.

Joint life survivor annuity

It keeps paying till either you or your spouse is alive.

Joint life annuity with return of purchase price

It keeps paying till you or your spouse is alive. In the case of the death of both, the nominee is entitled to get the initial invested amount.

Who should buy an Annuity plan?

If you want a guaranteed income for life, especially post-retirement, you should consider buying an annuity plan. The objective of an annuity plan is to ensure financial freedom during your retirement, when your regular income stops. You can use the payout from an annuity plan to cover your day-to-day expenses during retirement and to fulfil your post-retirement dreams, such as travelling, starting a venture, pursuing a hobby, and more.

What is the best time to buy an annuity plan?

Annuity plans provide you with the flexibility to start investing as per your convenience. If you are nearing retirement, you may have a large savings amount that you may want to invest. Some annuity plans provide you with the option to invest a lump sum and start receiving the income as early as the year following the purchase of the plan. You may also choose to receive the income at a later age.

If you are in your early earning years, you may want to invest smaller amounts towards your annuity plan regularly. Some annuity plans provide you with the option to invest regularly and receive income at a later age for your retirement. This enables you to invest small amounts, thereby making it easy on your pocket. It is important that you start investing in an annuity plan as early as possible.

Benefits of Annuity plans

a) Lifetime source of income

One of the key features of an annuity plan is that it provides a regular income throughout your life, even after retirement.

b) Multiple options to choose from

This offers you the flexibility to opt for a plan that suits your requirements. You may choose the single life option to get income for life, or the joint life option to cover your spouse as well. You may also opt to get the purchase price back after a certain period. Annuity plans provide multiple such options that help you customise the plan as per your needs.

c) Tax benefits

The premium you pay at the time of purchase of the plan is allowed as deduction up to ₹ 1.5 lakh under Section 80C of the Income Tax Act, 1961.

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).