The shares of companies in the Adani Group dropped sharply after an investment research firm called Hindenburg Research said in a report that the group had been “manipulating the market and committing accounting fraud.” The company said that the Adani Group has “significant debt” and their valuations could go down by 85%.

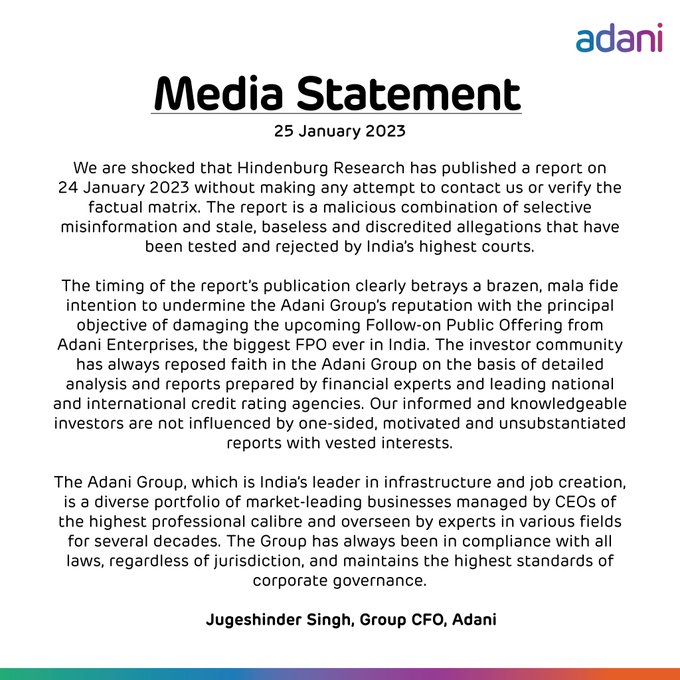

In response to the claims, Adani Group called the report a “malicious mix of selectively false information and old, unfounded, and disproven claims.”

What is Hindenburg Research?

It is a company based in the US that does financial research. It looks for mistakes in accounting, actions that are illegal or unethical, and problems that haven’t been made public.

On its website, it says, “We have decades of experience in the investment management business, with a focus on equity, credit, and derivatives analysis.”

It says, “We use fundamental analysis to help us decide how to invest, but we think the most useful research comes from finding hard-to-find information from unusual sources.”

Why did it get the name “Hindenburg”?

It was named after the Hindenburg disaster, which killed 35 people in 1937 when a German passenger airship caught fire.

“We think of the Hindenburg as the perfect example of a disaster that was caused by people and could have been stopped. A balloon with almost 100 people on it was filled with the most flammable substance in the universe (hydrogen). Even though dozens of other hydrogen-powered planes had failed in the past. Still, the people who ran the Hindenburg kept going, relying on Wall Street saying “this time is different.” “what its website says.

“We look for similar man-made disasters on the market and try to bring them to light before they trick more people,” the report says.

How did Hindenburg get started?

Nathan Anderson, a University of Connecticut student studying international business management, launched the business in 2017. Before moving back to the US, he resided in Jerusalem and worked as a broker for several businesses.

Nathan Anderson, a University of Connecticut student studying international business management, launched the business in 2017. Before moving back to the US, he resided in Jerusalem and worked as a broker for several businesses.

Anderson had previously worked with Harry Markopolos, who had warned about Bernie Madoff’s Ponzi scam, before starting the research firm. It then developed into the largest financial swindle to ever occur in history.

The Financial Times cited Markopolos as adding, “He [Anderson] is an expert miner.

If there are facts, he will find them, and all too frequently he will find that there are unsolved mysteries “.

With Hindenburg, Anderson had previously told FT that “we come in and attempt to spotlight some of these problems that could be hiding under the surface at some of these firms, in some of these industries, and see if we can make things better.”

What businesses has Hindenburg written about in the past?

The study, Nikola: How to Parlay An Ocean of Lies Into a Partnership With the Largest Auto OEM in America, was published in 2020. In the years prior to its planned alliance with General Motors, Nikola is accused of telling “a huge array of falsehoods and deceptions,” according to the report.

A manufacturer of electric vehicles named Nikola was accused of defrauding investors by boasting about new models when none actually existed.

The research firm has also published papers on HF Foods, Riot Blockchain, WINS Finance, and China Metal Resources Utilization.

Hindenburg Research says if Adani Group files lawsuit it will demand company documents

Hours after Adani Group retaliated on Thursday, claiming it is considering “remedial and punitive action” against Hindenburg Research in accordance with US and Indian law, the short-seller asserted that it fully stands by the report on the Indian conglomerate and thinks any legal action would be without foundation.

Hours after Adani Group retaliated on Thursday, claiming it is considering “remedial and punitive action” against Hindenburg Research in accordance with US and Indian law, the short-seller asserted that it fully stands by the report on the Indian conglomerate and thinks any legal action would be without foundation.

“To be clear, we would welcome the company’s threats of legal action. We firmly stand by our findings and think any legal action brought against us would be without foundation “the statement from the US-based financial research business.

Hindenburg said that if Adani Group sues the short seller in the US over its report on the Indian giant, it will want papers through the legal discovery process.

This week, Hindenburg Research published a study in which it claimed that Adani Group had manipulated results and concealed related-party transactions to “keep the image of financial health and solvency” of its listed business entities.

Here’s Hindenburg Research’s full statement:

In the 36 hours since we released our report, Adani hasn’t addressed a single substantive issue we raised.

At the conclusion of our report, we asked 88 straightforward questions that we believe give the company a chance to be transparent. Thus far, Adani has answered none of these questions.

Instead, as expected, Adani has resorted to bluster and threats. In a statement to media today, Adani referred to our 106-page, 32,000-word report, with over 720 citations and prepared over the course of 2 years, as “unresearched” and said it is “evaluating the relevant provisions under U.S. and Indian laws for remedial and punitive action” against us.

Regarding the company’s threats of legal action, to be clear, we would welcome it. We fully stand by our report and believe any legal action taken against us would be meritless.

Sources:

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).