What if you invest in stocks to grow your money and even if the market crashes, you still make money? Sounds like a WIN-WIN.

Edelweiss Twin Win Nifty is an amazing structured product that ‘guarantees‘ the higher of the two –

- Whatever the Nifty returns over the tenure of investment – OR –

- Fixed return (6 % p.a. ) in case Nifty falls

This makes investing in Edelweiss Twin Win Nifty a win-win for all its investors.

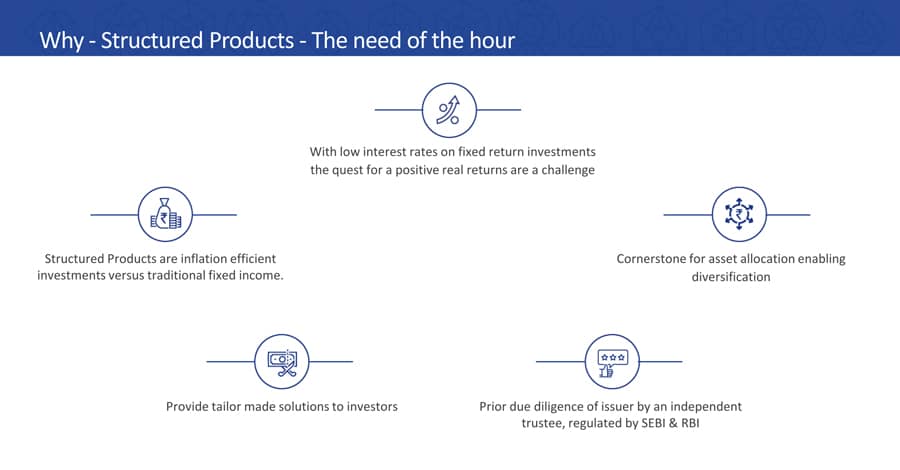

What is a Structured Product?

Structured product is a hybrid investment instrument which combines investment instruments such as equity, commodities or derivative to earn a fixed or variable rate of return with a pre-decided minimum fixed return. The combination allows the product to maximize the probability of generating higher-than-expected returns while keeping the downside in check.

The objective of structured product is to protect the principal and at the same time give stock market linked returns.

Return – The return of a structured product (which we will be talking about) is linked to the performance of Nifty. The returns generated by these products can range from 10–25% CAGR.

Ticket Size – Varies based on fund house.

Duration – Structured product requires an investor to stay invested in the product for a minimum amount of time to be able to reap the benefits of the product. For example – for 3 years.

Structured products are popular among HNIs looking to diversify their portfolio and aim to maximize the probability of achieving higher returns while at the same time protecting the downside risk i.e. principal protection. These products are issued by NBFCs such as Edelweiss Finance & Investment Limited, Reliance Capital and Anand Rathi Global Finance as non-convertible debentures.

Comparison with other Investment Options

| Instrument | Principal Protection | Liquidity | Risk | Potential of Maximizing Return | |

| Market Risk | Credit Risk | ||||

| Structured Products | Available | Low/None | Low | Low/Medium | High |

| Bank Fixed Deposits | Yes | Medium/High | None | Low | Low |

| Mutual Funds | No | High | Medium/High | None | High |

| Direct Equity | No | High | High | None | High |

| Derivatives | No | High | Very High | None | High |

Edelweiss Twin-Win Structured Solution

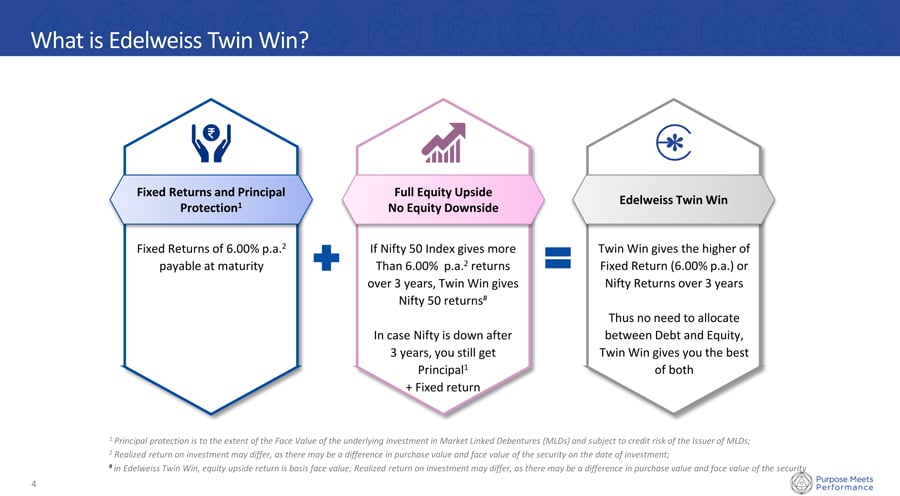

Fixed Return with Equity Upside

Edelweiss Twin Win ‘guarantees‘ higher of the two –

- Fxed return (6 % p.a. ) – OR –

- Whatever the Nifty returns over 3 years

Edelweiss Twin-Win Structured Product will invest 92% of the Portfolio in Edelweiss Cumulative Coupon Bond and the remaining 8% will be invested in Equity Linked Instruments. The amount invested in Cumulative Bonds will provide capital protection and the Equity Exposure will provide upside if Nifty grows.

| Your Investment (100%) | |

| 92% is invested in Edelweiss

Cumulative Coupon Bond |

8% Money is invested in Equity Linked Instruments |

| Provides Capital Protection and fixed return of 6% p.a. | Provides Nifty upside if Nifty gives > 6% p.a. return |

Features of Edelweiss Twin-Win Structured Solution

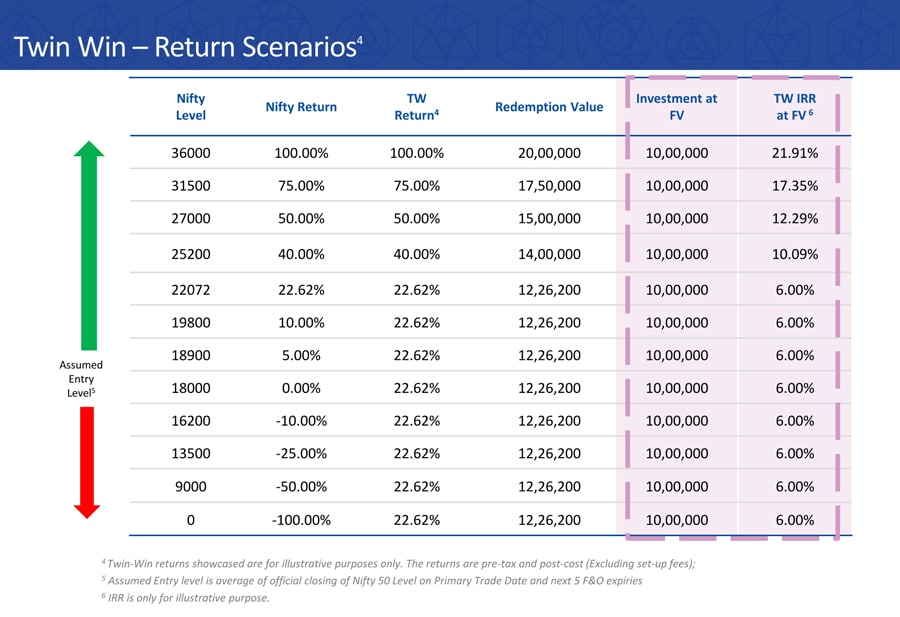

[1] Fixed Returns and Capital Protection – The product will provide a fixed return of 6% p.a. payable at maturity.

[2] Full Equity Upside | No Equity Downside

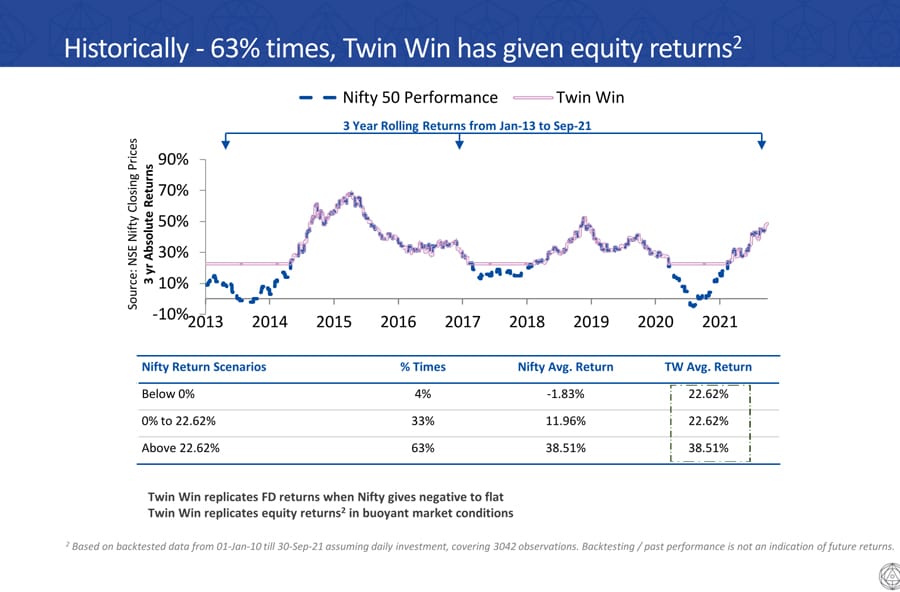

Scenario 1 – If the Nifty 50 index gives more than 6% p.a. returns over 3 years, Twin Win gives returns based on Nifty performance.

Scenario 2 – In case Nifty falls, you will still get Capital + Fixed return.

3] Tax Efficiency – 20%

4] Strategy Details –

- Invest in Listed, Rated and Principal Protected Market Linked Debentures

- Credit Rating: Minimum AA Rated

- Secured: Investment in Secured Debentures

- Market Dependent

- Minimum Investment: Rs. 10 lakhs

- Tenure of Underlying Investment: 3 years

- Return Profile – Maximum of 6% p.a. IRR basis issue price or Nifty Underlying Performance

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).