Many Indians are not the ones who take the risk and are more risk averse. However, in recent times people all over the world started investing in risky investment options favoring the high returns.

Even today, people have this confused notion between the unit-linked insurance plan and Mutual fund. Many think they are interlinked and have twin benefits of insurance with decent returns. But, in reality, the case is otherwise.

When it comes to returns, mutual funds are much better for the long term and can deliver decent returns. ULIPs on other hand are insurance policies and investment options with decent returns.

Mutual Funds

Mutual Fund is one of the most popular and low-risk investment options available today. Their primary objective is to pool the money from individual and institutional investors and invest in a variety of equity and debt instruments.

Mutual funds are managed by the fund managers making the investment decisions on behalf of the investors. They are the risk tolerance and liquid funds need the minimum tenure of just 7 days to equity mutual funds you can remain invested for a lifetime.

Unit-Linked Insurance Plan (ULIP)

ULIPs is also a financial product. it provides the benefits of both insurance policy offering an insurance cover and investment benefits to the investors. A proportion of the premium paid is considered insurance cover and the remaining are pooled and invested in debt or equity instruments.

Like other insurance, ULIP gets a subscription from the general public. In ULIP you can make your investment portfolio according to your goals, income, and risk meeting your financial needs.

Comparing Mutual Funds and ULIP

Over the last 10 years or so, ULIP mid-cap funds have given decent returns in line with the mid-cap MF schemes. According to Morningstar, ULIP Midcap funds gave a 70% annual return for the last year.

Lock-In Period

Equity Linked Savings Scheme (ELSS) which offers tax benefit on investment up to ₹1.5 lakhs per annum have a lock-in period of 3 years. Other funds which do not offer tax benefits do not have the lock-in period. But the exit load levied depends on the fund category. For equity funds, it is usually 1% if you redeem before one year.

ULIPs do have a lock-in period of 5 Years.

Transparency

Mutual funds are transparent about the fees charged and the portfolio holdings, asset allocation, fund managers, expenses, etc. it is regulated by the SEBI and hence, has transparency.

ULIPs on other hand are insurance and investment product. They are less transparent compared to Mutual funds as their asset allocation, expenses, etc. have a complicated structure.

Cost

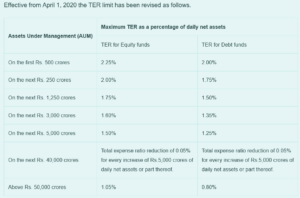

Mutual Funds charge a graded Total expense Ratio (TER). Which differs across various scheme categories. The expenses come down as the scheme’s assets under management (AUM) go up. In addition, Mutual funds charge additional 30 basis points for inflow of up to ₹2 lakh per transaction from retail investors beyond the top 30 Cities.

From July 2020 Mutual funds deduct 0.005% for the amount invested through both lump sum and SIP. If you invest ₹1 lakh in a scheme, ₹5 will be deducted and ₹99995 will be invested. The TER for the direct share class is cheaper compared to the commissions paid for the distributors in the regular plan.

ULIP has charged heavy charges and commissions and has earned a bad reputation regarding that. In September 2010, the Insurance regulatory and development authority of India (IRDAI) capped the annual ULIP charges at 2.25% for the first 10 years. The Fund management chargers are at 1.35%.

ULIP charges include Premium allocation Charge (12.5% pa) Mortality charges (depends on your age and sum assured), Guarantee charge (0.50%), Policy administrative charges (upto 5% pa or ₹500 per month), Surrender charges (depends on the year of surrender and premium amount, nill after 5 years), Fund switching charge (₹500 per switch) Rider charge, Alteration charge (₹500 per transaction), partial withdrawal charge (₹500 per transaction) and service charge.

Also, the insurance firms may charge for the discontinuing of the premium amounts.

Tax Benefits

In Mutual Funds tax benefits are applicable only to ELSS for the investment of up to ₹1.5 Lakh under section 80C of the Income Tax Act 1961.

In ULIPS, the premium amount paid is eligible for the deduction under section 80C and all the maturity proceeds are exempted from taxes under section 10(10D). Similar to the investment made up to ₹1.5 lakh in ULIPS are eligible for the tax deduction under 80C of the Income tax act. This deduction is restricted to the sum assured.

For ULIPs, Purchases made after Feb 1st 2021 the maturity proceeds with an annual premium of more than 2.5 lakh are taxed on par with equity-linked mutual fund schemes.

If your gains in equity-oriented ULIP exceed ₹1 lakh, the excess amount over 1 lakh is charged at 10% while the short-term capital gain tax is 15%.

Flexibility

Mutual funds have no such benefits and don’t offer any flexibility. Thus, the investor cannot switch over the various funds. However, switching is possible in different schemes but for the same fund house. As a result, it attracts the capital gain tax and exit load.

ULIPs on other hand provide such flexibility to switch between the funds like equity and debt and vice-versa, depending on the market performance. This switching can be done as many times as possible only limited by the terms of the various insurance firms. There is no tax implied on such a switch between the funds.

Investment Horizon

Mutual funds are for short-, medium- and long-term investment goals. Investors can choose the fund aligning with their requirements.

ULIPs are preferred to create a healthy corpus over the long term. Investors to get a better result out of their investment should stay invested for 5-7 years.

Returns on Investment

Returns from the mutual funds depend on the various schemes and the risk factors. Equity mutual funds have the potential to offer higher returns, while debt mutual funds offer slightly lower returns.

The ULIPs generally give lesser returns compared to mutual funds. The reason is, that ULIPs give a fixed amount whether or not the investment plan makes money.

Redemption Procedure

In Mutual funds, there is no such lock-in period except for the ELSS, so the investors can redeem their funds anytime. However, for a few funds exit load is charged if they are redeemed before the specified time period.

In ULIPs, investors can redeem units on the expiry or maturity of the ULIP. Also, one can surrender their policy and receive the surrender value only after the lock period ends. In case of the demise of the policyholder, the nominee will receive the sum assured or the value of the units, whichever is higher.

Conclusion

Both ULIPs and Mutual funds are very different from each other yet quite similar. An investor looking for a hybrid investment option like both insurance and investment can prefer ULIP over mutual funds.

In other cases, if one wants both the things insurance and investment should be separate can prefer to go with Mutual funds. Also, mutual funds are helpful when you have short and long-term goals.

Overall, there are a lot of schemes and options for anyone, thus, one should choose the decision wisely depending on their requirement and goals.

Also Read: Why Is Solid Financial Planning Essential for Women?