If you are a NRI, when you plan to visit India next on a holiday or for some work, you may have so many things to attend to. NRI Money Plus list out 9 most important must-attend issues that you have to take care of when you visit India.

Please make preparation well ahead of time. Start making the preparation in advance to help you to get these things done pretty quickly. I am going to detail to you the possible things that you might be required to attend when you visit India.

With NRI Money Plus, let’s look at them one by one.

1. Bank Accounts

- Visit bank and update your KYC

- Close all unwanted accounts

- Convert SB Account into NRO account

- Reinstruct liability EMIs to be collected from NRO A/c

- Inform all concerned the change of bank account details

- Keep account in two banks with good IT infrastructure

2. Demat Account

- Resident Demat should be converted to NRO Demat

- First change SB account to NRO

- Inform change of bank account to brokerage

3. PAN Card

- If you do not have PAN Card, apply for one

- Apply for E-PAN card

- Data entry errors if any should be rectified

- If you have multiple PAN Cards, cancel extra cards

4. Aadhar Card

- Not compulsory for NRIs to have Aadhar card

- Data entry error if any – get it rectified

- Name correction can be done once only

Contact details can be changed - Address can be changed

5. Indian Mobile Number

- It is advisable to have an Indian mobile number

- Enable mobile to receive SMS when abroad

- Tele-service provider may charge a fee for this

6. Visit to Chartered Accountant

- Check if you need to file tax returns

- Check if any TDS is made against your PAN number

- Check tax benefits you may get under DTAA agreements

- Record NRI status on your PAN number in income tax website, if not done

- Check if you need to make any overseas asset disclosure

7. Property-Related Issues

- Check your property obligations

- Have you paid the property tax?

- Have you paid association dues?

- Attend to maintenance issues

- Locate a good service person for future works

8. Loan Accounts

- Have you closed loans since your last visit?

- Take back documents of collaterals given to bank

- Demand loan closure letter from bank

- Insist on nil balance letter from bank

9. Your Parents

- Check their economic status

- Do they need financial assistance?

- Do they have sufficient health insurance

- Consider buying a top-up health plan for them

- Do they live in a secure place?

- Do they have helping hands in times of need?

1. Bank Account

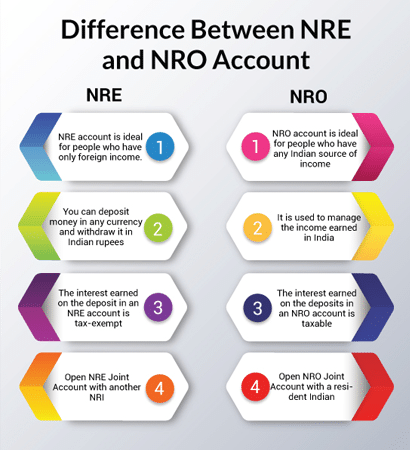

When you visit India, the first thing that you have to do is, if you have not updated your KYC records with your bank, walk to a branch office and get the KYC done then and there itself. Update your visa status, update your latest passport details, update your country where you reside, your overseas address, and provide all documentation that is required to keep your KYC up-to-date in the bank account.

Likewise, you could have left some of the bank accounts not converted into NRO accounts, and you could still be operating with the resident SB or saving bank account. Moreover, you could be having a resident SB account in multiple banks. As an NRI, to maintain a resident SB account is a violation of FEMA law. Closure of this account could not have been possible for you to do when you are abroad. Now, when you are here, walk into all those banks where you are maintaining the Savings Bank account. If you don’t need them, please close them, at least in one bank or two banks. It is better to maintain the accounts, and you convert your resident SB accounts into NRO accounts. If you are having accounts in some of the banks where the IT infrastructure is not good (example – cooperative banks, small banks, or a PSU bank), it makes sense for you to open an account in a bank that has really good IT network. Some of the private banks like ICICI Bank, HDFC Bank, Axis Bank, Kotak Bank, and even SBI (State Bank of India) for that matter have got excellent IT infrastructures. As an NRI, you should be able to operate your account from abroad without much difficulty. So it makes sense for you to carry at least two bank accounts that have got excellent IT infrastructure. Close all other bank accounts.

While converting the resident SB account into NRO account, a question could come to your mind – “What should I do with my housing loan EMI or collection of my rents and other commitments or liabilities, which are attached to this bank account?” Speak to your banker as in most banks when you convert your SB into an NRO account, they will maintain the same bank account number, so you don’t have to do anything. The EMIs and the liability or commitment towards any other loan that you have taken, your rental receipts, or any other receipts that you have to collect will come back into the same account. If the account number gets changed, talk to your banker and make sure that you redirect the collection of those liability payments that you are making from your NRO account.

2. Demat Account

If you are an NRI and holding a demat account with resident status, it is a violation of law. You must convert this demat account into an NRO demat account. If you have a demat account attached to one of the banks, walk into the bank’s branch or the brokerage attached to the bank, and declare your status. Ask them to convert this into an NRO demat account. If you have a brokerage account in some other brokerage house, which is not a bank, you have to go to the brokerage company, inform them about your resident status, and update your KYC. Get the demat account changed to an NRO demat account. Likewise, when you change your demat account into an NRO account, the bank account also has to be changed first. So, first, create your NRO bank account, and then visit your brokerages like ICICI Direct or HDFC Securities or Angel Broking or any other brokerage and give them the new bank account. Ask them to convert your demat account from a resident status non-resident status.

3. PAN Card

If you are a NRI, you MUST have a PAN card. Without a PAN card, you will get stuck during transactions. Yes, you can give a declaration that you do not have a PAN card, but you will be crippled without a PAN card, as there are 3 sets of problems that you might encounter when it comes to a PAN card.

#1. I don’t have a PAN card – If you do not have a PAN card, getting one is pretty easy wherever you are in India. In the storm cast, there are plenty of centers which can offer you the PAN card services. Walk into them, and in less than about 2 weeks’ time, you will be able to get a card. When you get a PAN card, make sure that you get an e-PAN card. If required, you can print one also. Having an e-PAN card will help you because it will come on your mail, and you can store it wherever you are, and it will not get lost for you.

#2. Some people have got multiple PAN cards. It is a crime to have more than one PAN card. If you have one, please make sure you cancel the PAN card, which is a duplicate or which is an excess one you want. You are having and retain only the one. There is a procedure to be followed here. Please talk to your chartered accountant. Get that extra PAN card, which you might have cancelled. It is a must-do.

#3. The third problem that you might encounter is the data entry on your PAN card could be wrong. The chances are that spelling errors could be there in your name. The sequence of data entry, which is mentioned, your first name, second name, middle name, initials, parents’ name could have been put in a different order. There, all your records should match with the PAN card. If you notice something which is a chain, there you can get it altered by providing the requisite document. So get that thing done during this visit to India. I have seen a PAN card where the dates of birth are completely different from the other records like their birth certificate or a passport. So even if the date of birth is reflecting something different of the PAN card, even that can be changed. You make it once, make sure that your bank account, your passport, your PAN card, everything reflects your name and data in the same pattern.

4. Aadhaar Card

An Aadhaar card is not a must for NRIs to have an Aadhaar card, but if you have already acquired one, it’s time to check all the details. If there is a mismatch of your name in the Aadhaar card, you can correct it only once in your lifetime. Walk to the nearest Aadhaar centre (there are many centres all over the country now) and get those corrections done in your name. Give them the documentary evidence, they will take your fingerprints, make sure that it is you who is attending to this, and send it right.

You can update your contact details if your telephone number, email, or address has changed. Those can be changed as many times as you want. It’s a good thing to visit the Aadhaar centre and update your latest contact details. However, you cannot update your international contact number over there. You can only put your Indian number.

5. Indian Mobile Number

Check whether you have got an Indian mobile number. Even though it looks like an option, personally what I feel is, it is better as an NRI to have an Indian mobile number and get it updated in your bank accounts, your aadhaar card, and wherever you need to. It will make your life much easier if you have to get an OTP from your bank or you need to get an OTP for any other transactions. If you have an Indian mobile number, it becomes very easy. Talk to your telephone operator, inform them where you live. If there is anything that needs to be done, tell them that you have to update your overseas address for them or if you have to get your OTPs abroad. Each telephone operator may have a separate rule. It’s a good idea to walk into that telephone operator’s office and ask them what needs to be done. You have to pay some small amounts of money every month to keep your telephone active when you are outside of India, but I personally feel it’s a worthwhile thing to do and keep an Indian mobile active when you are abroad.

6. Visit Your Chartered Accountant

This is something a lot of people will avoid. They think, “I’m an I am not required to file a tax return. I don’t need to consult a chartered accountant.” Probably better to differ here. It is best, at least, to visit a chartered accountant and inform them of your status, what you have, and what you need to do regarding your tax. Complex may be some TDS have been done against your name, and you have not filed a return, and it gets recorded. You may be under the impression that you don’t need to file a tax return. Probably, there is a case that you have to file a tax return. In some TDS, have been done against your name, and you just thought of a small amount of tedious has been done. “I am not required to file the tax return.” It’s better you consult your chartered accountant, explain your case, give your PAN card number, and let them check your records from the IT. If there is anything that needs to be done, likewise, if you have not updated your NRI status in your PAN card, take the help of your chartered accountant and ask them to update your NRI status with your PAN card.

You could be living in some other country, and that country has a DTAA agreement with India. Talk to your chartered accountant and find out if there are any benefits that you can derive by using this DTA agreement between two countries. We have done a lot of videos on this particular subject. You can visit the relevant playlist on our channel “NRI Taxation.” My guest faculty Mr. Sriram has done fantastic work around DTAA agreements, and he has detailed videos done on what benefits you can derive from that. Do not neglect these things, and there are a lot of benefits you can derive by getting into details of DTAA agreement. When you are with the chartered accountant, please mention the assets that you have outside of India. Is there a need for you to disclose these things while filing the tax return? Being very transparent with your chartered accountant, give him or her all the details pertaining to you, and let them take a professional review of what all the things that need to be done. If you attend to these things in time, you can save a lot of trouble in the future.

7. Your Property and Property Records

Check if you have paid the tax on the property. Whether there are liabilities pending for tax payments, you should check the maintenance of the property. If there is anything that needs to be done, it is not easy to get the service man in India. It is very difficult to find painters, plumbers, and all these things. It might take a lot of time. You should have gotten into it as soon as you come to India. It is a good idea during this visit to find a good service man or a contractor who can help you in your absence. Have his number, and he will have good trust with him, a good contact with you. That could be a helping hand for you when you are abroad if something needs to be done.

Likewise, check from the property department or some service man, is there anything else you need to be doing with respect to your property like a property card, or if some new documentations have to be done. See the law landscape keeps changing. Find out from people if there is anything else you need to be doing when it comes to the question of your properties.

Likewise, if you have a tenant, you can visit the tenant to see whether he has paid the rentals and everything correctly or not. If there is any problem in the property, have you paid your dues to your association or not? Association rules are not very stringent in India. Many NRIs misuse this. They don’t pay the association their dues on a timely manner, and this can land you into trouble. The association can take action against you. In the may, cut off water supplies or electricity, and you will be inviting unnecessary trouble. This is an avoidable thing. So talk to your association, find out if there are any dues from your side, and please make sure you clear all of them.

8. Loan Accounts

Check your previous loans from the time you visited India last time. What are all the loans that you have cleared? If you have cleared the loan and if it is against a collateral, for example, you have given your property as collateral, walk into the bank or financial institutions, collect your original property records back. We opened the loan likewise, you should also take a New Balance letter if a bank closure letter telling that this loan has been closed. Take that letter, file it or keep it in your mail folder or in a proper place. If they don’t give a closure letter, ask them to give you a nil balance certificate or nil balance statement showing that you have cleared that particular loan, so you are out of it. At somebody, somebody should not tell you that you have a pending interest to be paid or something pending. Make sure that everything is in order when it comes to the question of your cleared loans as an NRI.

9. Parents

When in India, attending to specific issues pertaining to your parents is crucial. Take the time to talk to them and find out about their economic situation and financial positions. Most parents may not want to discuss their financial conditions with their children, but it is your duty to find out. Are they comfortable, struggling, or living in difficult circumstances? You can gauge their situation by observing their living conditions. If they are struggling, see how you can help. Can you give them a fixed amount monthly or deposit some money into their account? Understand that your parents have made a lot of sacrifices to provide you with a good education. In their efforts to do so, they may have overlooked planning for their retirement corpus, whether due to negligence or ignorance. This is a common situation for many parents.

Have a kind heart and talk to your parents. Check their living conditions and assess if they need help. If they do, do your best to keep them in an economically stable state. Look at the safety and convenience of their home, and encourage them to move to a safer place if necessary. Ensure that they have adequate health insurance. Do not take their word for it; they may only have a basic policy of ₹50,000 to ₹2,00,000 from a government insurance company. At their age, this amount may not be sufficient. As they age, the probability of hospitalization increases. It is a good idea to give them a top-up plan, if they are eligible, in case they need to spend time in the hospital and the bills escalate. If they do not have an adequate health insurance policy, it becomes your responsibility to bear the costs. Be kind and gift your parents a health insurance policy, and if they already have one, give them a top-up policy.

Financial matters are complex, more so if you are an NRI. But managing them is not impossible.”

Donald G. is the Principal Consultant at NRI Money+. He specialises in creating personalised financial plans for NRIs (Non-Resident Indians) and HNI (High Net-worth Individuals).